Is Your App Builder Holding Your Brand Hostage? 5 Counter-Intuitive Truths

For a new brand, mobile app builders like Tapcart and Vajro are a pragmatic starting point. They offer a fast, easy, and cost-effective way to establish a mobile presence and validate the channel without a significant upfront investment. They are, in essence, the perfect tool to get started.

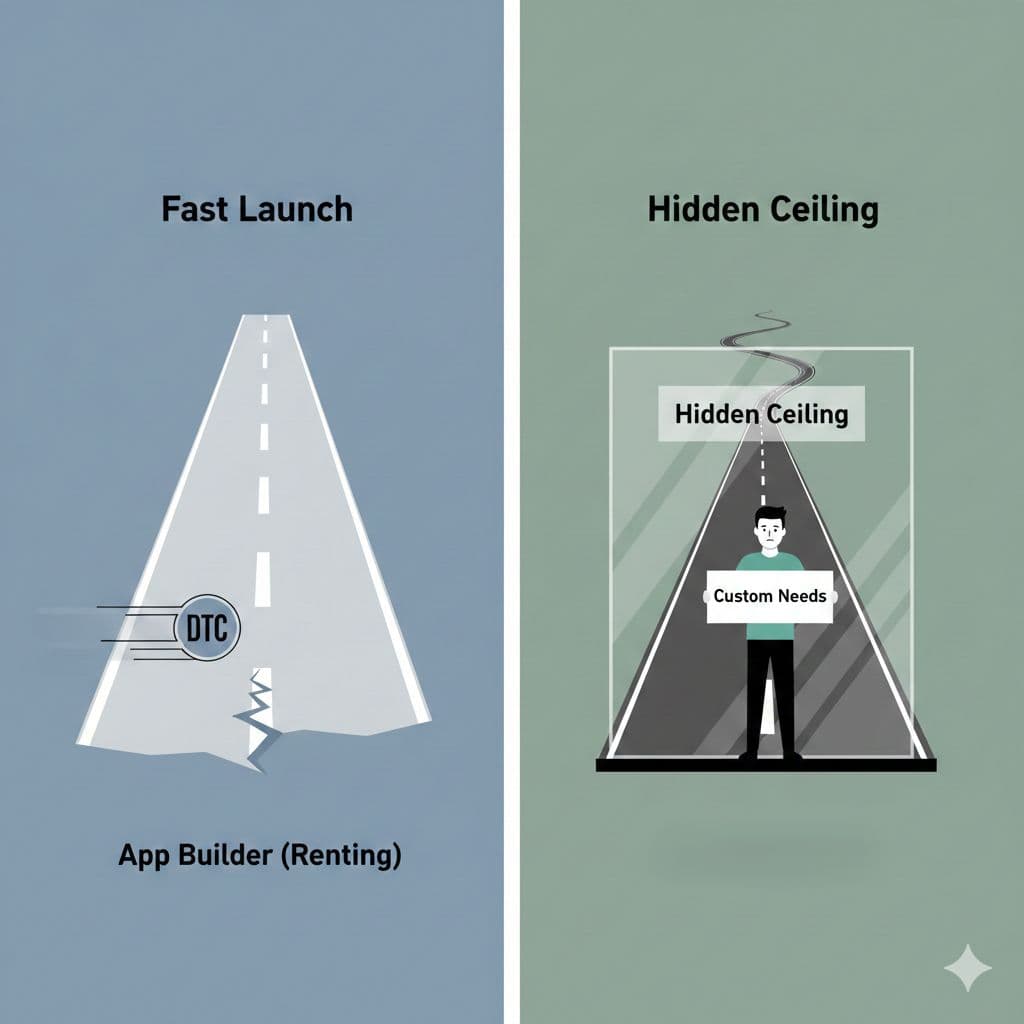

The problem—the scaler's dilemma—arises as your brand grows. For businesses scaling into the $5 million to $50 million GMV range, a fundamental conflict emerges. The very simplicity and template-based structure that made the builder attractive now transforms into a catastrophic constraint. This is the "hidden ceiling": the point where the tool that helped you start becomes the primary obstacle preventing you from growing further.

This article reveals the four most impactful and often surprising reasons why successful brands must graduate from app builders. It's not just about adding features; it's about breaking through this ceiling by transitioning from a rented, restrictive tool to a wholly-owned, revenue-accelerating asset.

1. The Financial Trap: Your "Affordable" App is Secretly Costing You a Fortune.

The advertised low monthly fees of app builders, such as Tapcart's $250/month Core plan, are a siren song for new businesses. However, this pricing is misleading for any brand serious about growth. The features essential for scaling are systematically locked behind expensive, custom-priced "Enterprise" tiers. Vajro’s premium tiers reach up to $999/month, and Tapcart’s Enterprise plan often starts at $1,000 per month or higher.

To access capabilities like unlimited custom blocks or premium integrations with sophisticated tools like Klaviyo, Skio, and Braze, you are forced into the highest pricing stream. This is the "SaaS Tax"—a perpetual operational expense (OPEX) that builds zero equity. Over a three-year period, these rental fees can easily surpass $40,000, an expenditure that provides zero residual value.

In contrast, a custom build is a capital expenditure (CAPEX). While the initial investment is higher—typically ranging from $150,000 to $500,000+—it creates a lasting, amortized asset for your company. The true cost of the builder isn't just the fee; it's the suppressed revenue potential and revenue leakage from being unable to implement the unique features that drive growth. The choice is not about comparing a monthly fee to a one-time cost; it's about making a strategic investment to eliminate a perpetual liability.

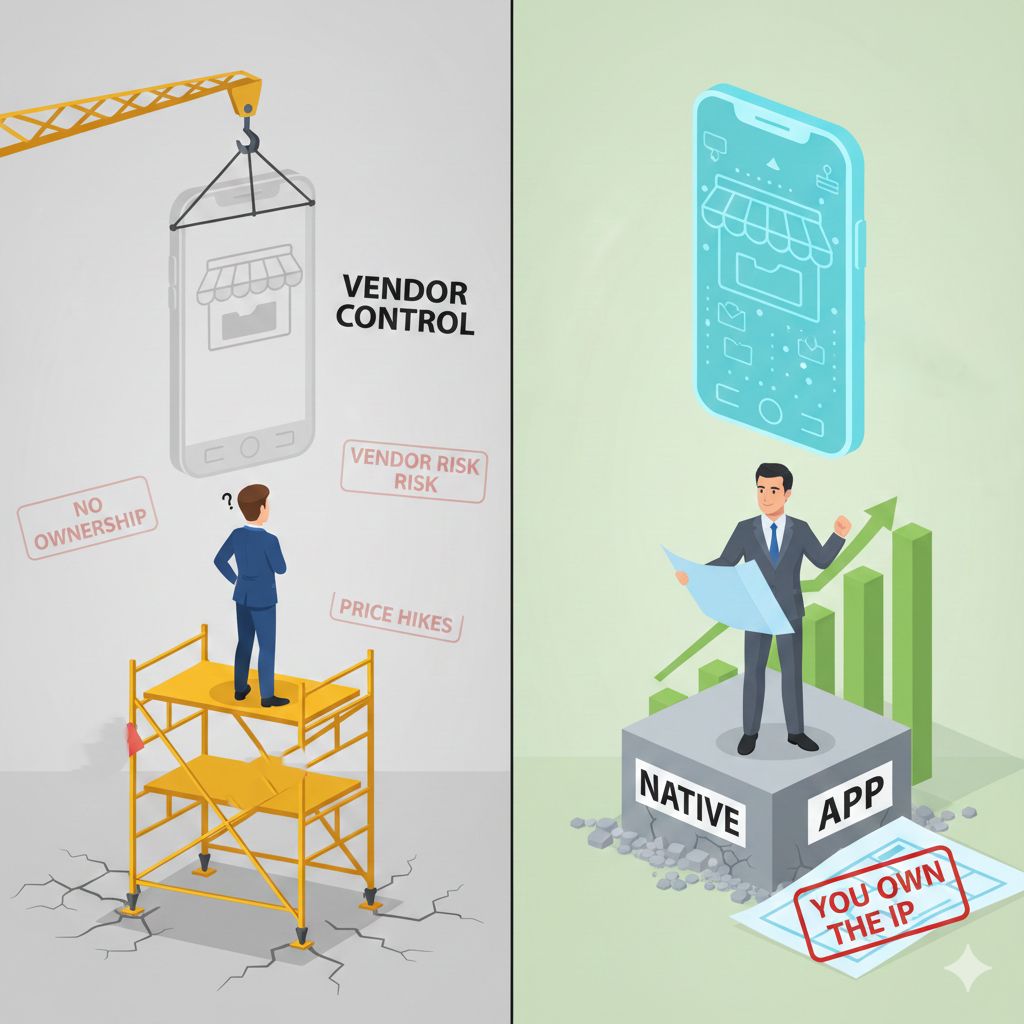

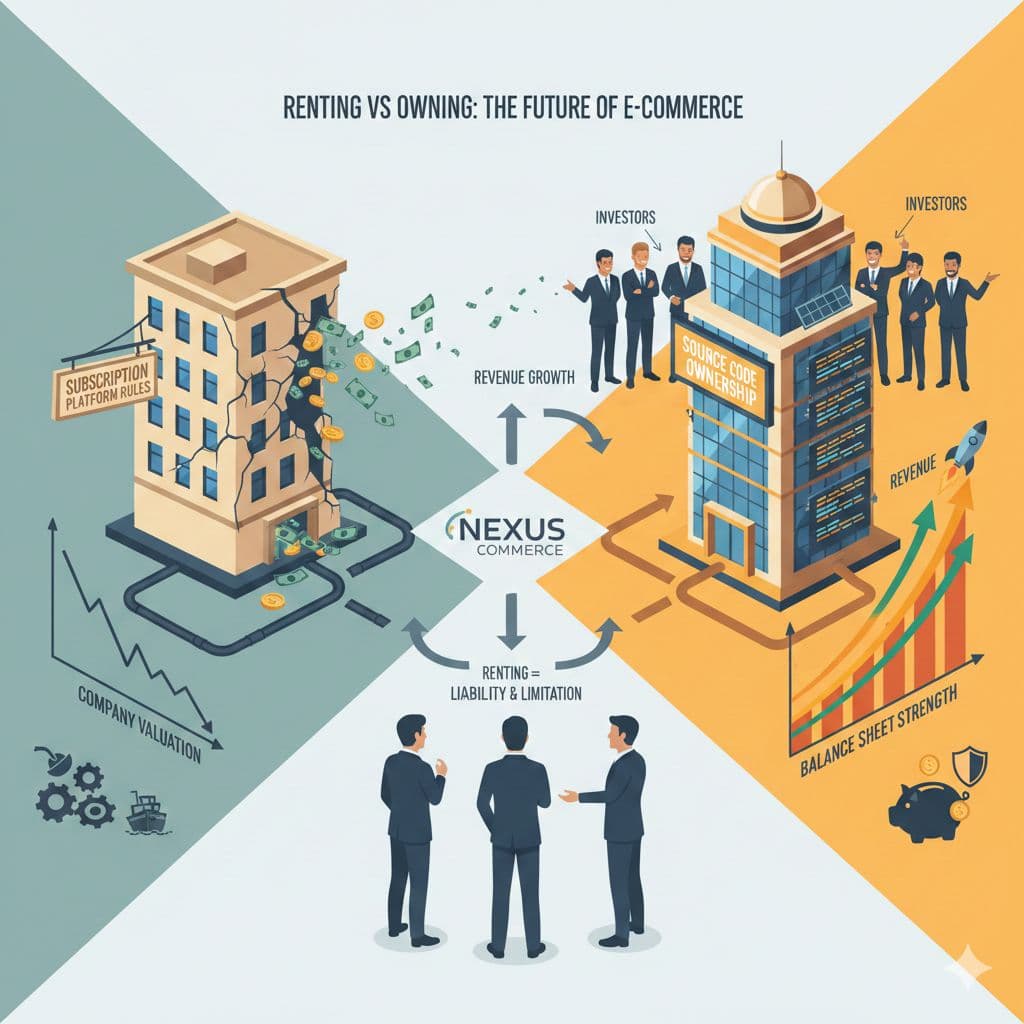

2. The Ownership Illusion: You're Renting, Not Building an Asset.

The most critical distinction between using a builder and commissioning a custom app lies in Intellectual Property (IP). With a SaaS app builder, your brand is only licensing the technology. The vendor—be it Tapcart or Vajro—owns the proprietary framework and underlying code. While you own your content and customer data, you do not own the core technological asset itself.

In the SaaS builder model, the brand is perpetually renting a license to use the app shell... The vendor maintains ownership of the proprietary framework and underlying code. This structure provides zero residual value upon termination of the contract.

This lack of ownership becomes a major liability. For companies seeking investment or preparing for an acquisition (M&A), owning core technology is a massive factor in company valuation. During due diligence, reliance on a third-party, licensed framework is a major red flag that can lead to a substantial discount on your company's valuation. Furthermore, it exposes you to vendor risk: arbitrary price increases, platform failure, or acquisition could jeopardize your mobile channel with no recourse.

A custom app, by contrast, transforms a monthly expense into a tangible asset on your company's balance sheet, a major step in maturing your company's financial structure.

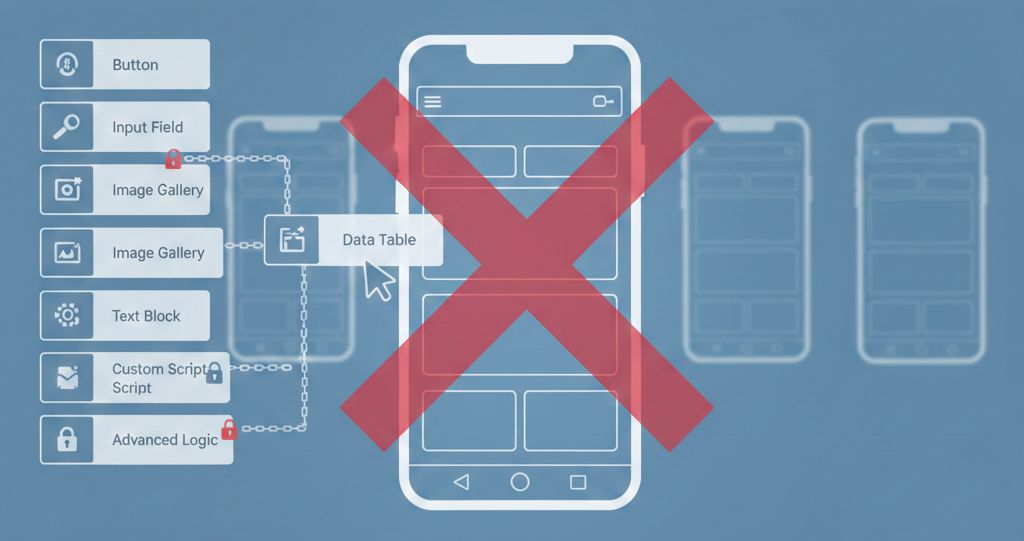

3. The Differentiation Deficit: Your App Forces a "Cookie-Cutter" Experience.

The speed of app builders comes from their template- and block-based systems. While efficient for initial setup, this "technical rigidity" inherently limits brand expression and competitive differentiation. It becomes nearly impossible to create a truly bespoke, premium user experience that mirrors the sophistication of a custom web storefront, leading to a disconnected customer journey.

This deficit is most obvious when you try to implement unique, revenue-driving features that are out of reach for builders. Concrete examples include:

• A custom product configurator that allows customers to build and visualize personalized items.

• Bespoke product bundling logic with dynamic pricing and inventory management.

Perhaps most critically, choosing a builder actively prevents you from future-proofing your tech stack. Builders like Tapcart and Vajro are fundamentally incompatible with modern composable architectures like Shopify Hydrogen or Shogun. This "Headless Incompatibility" means that if your brand plans to adopt a modern, headless strategy to manage complexity, your app builder becomes a technical dead end.

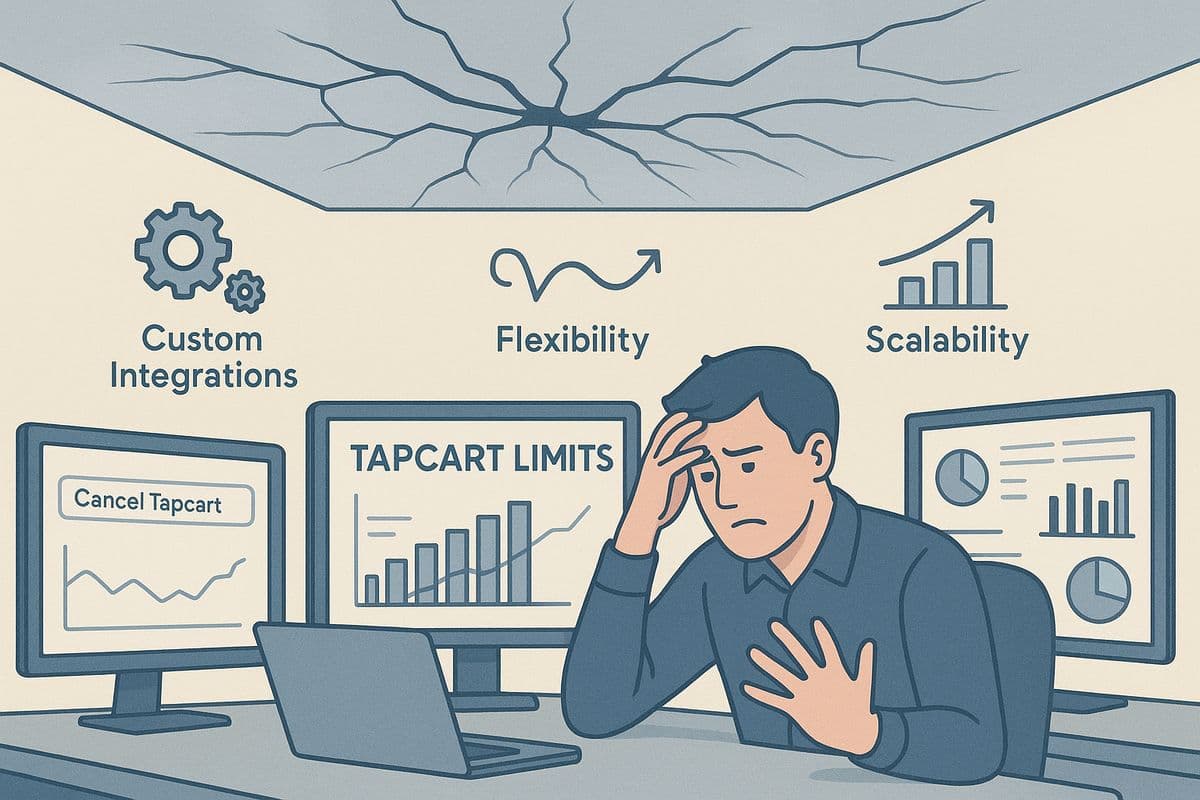

4. The Integration Wall: Your Tech Stack is Being Choked.

App builders often market their dozens of "seamless integrations." However, for a scaling business, there is a critical difference between the "standard" shallow integrations they offer and the "deep" integrations your operations require. Builder APIs are typically designed to pass only basic, predefined data.

Consider an Enterprise Resource Planning (ERP) system like NetSuite. A scaling brand requires robust, secure, two-way data flows with its ERP to manage inventory and logistics with absolute accuracy—a task for which builder APIs are completely insufficient. They lack support for enterprise security protocols like SAML Single Sign-On (SSO) and introduce unacceptable operational risk.

This limitation also applies to complex subscription and loyalty programs. The builder’s restricted front-end control means it cannot support the requisite bespoke front-end rendering for these complex flows. The resulting experience is often clunky and disconnected, hurting customer lifetime value (LTV). As your operational complexity grows, you inevitably hit the "Integration Wall"—a point where the builder's limited connectivity throttles your ability to scale.

5. Graduate from Renter to Owner

App builders are a fantastic tool for starting a mobile journey, but they are not the destination for an ambitious, scaling brand. The strategic crossroads demands a choice between the high, perpetual costs of a rental and the superior, revenue-accelerating potential of a capital investment.

The limitations are not minor inconveniences; they are a ceiling on your growth, defined by three realities:

• The Financial Reality: The perpetual "SaaS Tax" of enterprise tiers results in a poor Total Cost of Ownership and prevents the accrual of valuable assets.

• The Technical Reality: The "Integration Wall" and "Technical Rigidity" block competitive differentiation and create significant operational risk.

• The Strategic Reality: The lack of an "IP Guarantee" diminishes company valuation and exposes the brand to unacceptable vendor risk.

Your app should be a revenue accelerator, not a rental liability. Which have you chosen?

Related In-Depth Guides

Your SaaS App Isn't an Asset, It's a Liability: The Valuation Mistake Costing Founders Their Exit

1.0 Introduction: The Scaling E-commerce DilemmaFor fast-growing e-commerce brands, the conventional wisdom is clear: SaaS mobile app builders offer a fast, seemingly low-cost entry into the mobile channel. They promise speed and convenience, making them an appealing first step for any brand looking to engage its customers on their phones.However, a counter-intuitive reality emerges for high-growth brands, especially those scaling past the $5 million GMV mark. This conventional path can quickly become a strategic trap, creating severe financial and valuation consequences that are often overlooked until it's too late.This article reveals the most surprising and impactful reasons why owning your app's code is not just a technical detail but a critical strategic decision for long-term value creation and a successful future exit. We will explore how the choice to "rent" versus "own" your mobile app directly impacts your company's balance sheet, its attractiveness to investors, and its ultimate sale price.2.0 Takeaway 1: Your App Isn't a Monthly Bill—It's a Capital AssetThe most fundamental difference between using a SaaS app builder and commissioning a custom build lies in how the expense is treated on your financial statements. This isn't just accounting jargon; it's a distinction that dramatically alters how investors and acquirers perceive the value of your business.A SaaS app subscription is an Operating Expense (OPEX). It's a recurring cost that hits your profit and loss statement every month, directly reducing your reported earnings (EBITDA). Functionally, it's no different than renting an office—you pay for access, but you build no equity.A custom-built app where you own the code is a Capital Expenditure (CAPEX). This strategic investment is classified as a proprietary, Intangible Asset on your company's balance sheet. The cost can be amortized over its useful life, smoothing the expense over several years instead of taking a monthly hit to profitability.Treating your app as a capitalized asset improves key profitability metrics and signals a commitment to building long-term, transferable value. This is a powerful demonstration of strategic foresight that is highly attractive to investors and helps justify a higher valuation multiple.A technology company with high recurring OPEX due to significant platform licensing fees may present a lower EBITDA, potentially resulting in a suppressed revenue multiple during acquisition. Conversely, a company that has actively invested in and capitalized its core technology asset demonstrates commitment to long-term, transferable value creation, justifying a higher technology multiple.3.0 Takeaway 2: You're Accidentally Sabotaging Your Company's Future SaleDuring a Mergers & Acquisitions (M&A) process, potential buyers conduct rigorous IP due diligence. One of their primary goals is to verify clear and undisputed ownership of all critical technology assets. This process revolves around the "chain of title" for your source code. If you cannot provide a clear, documented history that proves you unequivocally own the code your app runs on, it is a primary "deal-breaker" for acquirers. They need to know they are buying an asset, not a liability.This is where SaaS builders introduce a massive, often unforeseen, risk. A buyer isn't acquiring a proprietary asset you built; they are acquiring dependency on a third-party vendor they cannot control. This "vendor lock-in" is viewed as a major proprietary risk that directly leads to a reduced valuation. The buyer is essentially purchasing a revenue stream that is contingent on a relationship with another company, exposing them to future price hikes, service changes, a decline in quality, or even the catastrophic risk of the vendor going out of business entirely.Furthermore, SaaS platforms obscure a critical legal risk: open-source license compliance. Acquirers performing deep technical diligence will look for "copyleft" licenses that could legally compel you to release your proprietary code. An owned app allows you to meticulously manage this exposure; a SaaS app presents a black box, creating a potential legal time bomb that can detonate a deal.The severe consequence is that a scaling brand might believe it's building a valuable asset, but by using a SaaS platform, it is actually introducing a fundamental risk that could lead to a significantly reduced offer or kill a potential acquisition deal entirely.4.0 Takeaway 3: The "Convenience" of No-Code Comes with a Hidden Performance PenaltyNo-code and low-code platforms build applications using generalized, pre-built components. They are designed to work for everyone, which means they are not optimized for anyone's specific needs. This generalized approach results in "bloated code." In simple terms, your app is forced to carry extra, unnecessary code for features and functions it doesn't even use. This unnecessary baggage makes the application heavier, slower, and more prone to performance issues.This technical problem has direct and severe business consequences:• Slower performance and delayed loading times lead to user frustration.• A higher probability of crashes damages brand credibility.• Poor user experience increases cart abandonment and decreases customer retention.The irony is that the initial time and money saved with a SaaS builder are often completely nullified by the persistent negative drag on crucial revenue metrics like Customer Lifetime Value (LTV)—the very metrics that potential acquirers scrutinize most intensely. This persistent drag on user experience not only erodes revenue directly but also creates a hidden operational tax, forcing teams into costly manual workarounds to compensate for the platform's shortcomings.5.0 Takeaway 4: Your "Affordable" Subscription Has Hidden Costs That Compound Over TimeThe low upfront cost of a SaaS subscription is its main appeal, but this view is dangerously shortsighted. A proper Total Cost of Ownership (TCO) analysis over a 3-to-5-year period often reveals a different financial reality. For scaling brands, the cumulative cost of high-tier SaaS subscriptions, which can start at 1,000–1,199 or more per month, frequently surpasses the investment for a custom build.Consider this concrete 5-year financial model:• Custom Build: A 150,000CAPEX∗∗investmenttocreateaproprietaryasset,plusapredictable∗∗30,000 annually for maintenance (20% of build cost).• SaaS Builder: A $14,400 annual OPEX subscription fee.Over five years, the SaaS subscription totals 72,000∗∗inpurerentalfees,creatingzerobookvalue.Thecustombuildhasa5−yearTCOof∗∗300,000, but this is not a simple comparison. The $300,000 investment yields a capitalizable, transferable, high-ROI asset that increases your company's valuation—an asset you own outright. The $72,000 yields nothing but a receipt for services rendered.The SaaS price also hides compounding costs like subscription creep—unavoidable price hikes as you scale—and operational drag, the real cost in staff wages and inefficiency spent creating manual workarounds for features the platform doesn't support. In contrast, a custom app's maintenance budget is a managed investment in preserving and enhancing a strategic asset that you own and control.Conclusion: Are You Building Value or Just Renting It?The decision is not merely about budgets; it is a choice between building strategic independence or accepting perpetual vendor lock-in. For founders focused on maximizing their exit, an owned, proprietary app is not an expense—it is the purchase of the highest possible valuation multiplier in the technology acquisition market.While SaaS builders offer a convenient on-ramp, they transform your technology into an operational liability characterized by limited differentiation, unmitigated M&A risk, and zero IP defensibility. The only path to maximizing shareholder return is through the creation of a capitalizable asset that guarantees strategic control and unlimited feature velocity. As you plan your company's future, you must ask a critical question:Is your mobile app building your company's long-term value, or is it just building your vendor's?

.png&w=3840&q=75)

5 Surprising Truths About Why Your SaaS E-commerce App Might Be Holding You Back

Introduction: The Mobile ParadoxWelcome to the mobile paradox: mobile devices drive the overwhelming majority of e-commerce traffic, accounting for 70-75% of all visits, yet they convert at a frustratingly lower rate than desktops. Global mobile conversion rates average just 2.8%, while desktop sits higher at 3.2%. This efficiency gap isn't a minor rounding error; it's a massive source of lost opportunity, contributing to the staggering $260 billion lost annually to cart abandonment worldwide.For ambitious, high-growth brands, this inefficiency can be traced directly to an unexpected source: the very SaaS app builder chosen for its convenience. Closing this conversion gap requires moving beyond conventional wisdom. For market leaders, the path to unlocking this trapped revenue begins with challenging the very foundation of their mobile strategy: the SaaS app builder.1. The Long-Term Cost Illusion: Your "Affordable" SaaS App is a Financial TrapThe most common justification for choosing a SaaS app builder is its low upfront cost. It’s an operational expense (OPEX) that feels manageable on a monthly basis. However, this is a dangerous illusion.The surprising truth is that total spending on a SaaS subscription over five years is typically 72% higher than the initial capital expenditure for a custom application. The financial data doesn't stop there. The average five-year Return on Investment (ROI) for a custom app is 55%, significantly outperforming the 42% average ROI for SaaS implementations.This reframes the entire decision. A custom app isn't just an expense; it's a capital investment. It becomes a capital asset on your balance sheet that contributes to your company's valuation and generates long-term ROI, rather than a perpetual operational cost that only ever increases.2. The LTV Explosion: Custom Apps Don't Just Improve Sales, They Multiply Customer ValueIn e-commerce, Customer Lifetime Value (LTV) is the ultimate metric for sustainable success. This is where a custom application moves from a "nice-to-have" to a strategic necessity. The data is striking: mobile app users generate a 5x to 7x higher LTV than mobile website users.Rainbow Shops, for example, reported a 7x higher LTV for their mobile app users compared to mobile website users, while BoozeBud achieved a 5x LTV and 4x ARPU increase from their app user base.How is this possible? A custom app provides an owned, low-cost communication channel directly to your most valuable customers through push notifications. This channel is profoundly more effective at driving repeat purchases than any other. Case in point: Volcom recorded a 127.2% higher purchase rate from its push notifications compared to its paid advertising efforts and a 124.8% higher rate than email.While SaaS platforms offer push notifications, a custom app provides unrestricted access to user data, enabling hyper-personalized, automated sequences—like the abandoned cart notifications that drove a 16.9% conversion rate for Recode Studios. This level of granular control over the communication channel is what builds a powerful, proprietary engine for retention and LTV growth.3. The Hidden Revenue Ceiling: When Platform Limits Cap Your Best IdeasSaaS builders are designed for simplicity, but that simplicity comes at the cost of flexibility. As your brand grows, you'll inevitably hit a hard limit on monetization, especially with complex revenue models like subscriptions.Consider this specific, real-world example: Shopify’s native Bundles API does not support subscriptions. This means a brand using a SaaS app builder on the platform is fundamentally unable to sell a high-value subscription product bundled with a one-time physical product. Any attempt results in technical failures at checkout.This isn't a minor bug; it's a platform-level constraint that blocks a critical, recurring revenue strategy. This is the definition of vendor lock-in: your most critical revenue strategies are held hostage by a third-party's development priorities, turning your growth roadmap into a feature request ticket. It's no wonder that 64% of companies report regretting their SaaS choice due to this exact lack of flexibility.4. The Data Blind Spot: You Can't Personalize What You Can't MeasureFor high-growth Digital Native Vertical Brands (DNVBs), data isn't just a reporting tool—it's the lifeblood of optimization. While the analytics tools in most SaaS builders are "serviceable," they lack the granular depth required for serious personalization. This data gap is a direct drain on your revenue.Modern AI-powered personalization strategies are proven to increase revenue by 10-15%, with top performers seeing gains of up to 25%. However, these advanced personalization engines require complete control over data collection, analysis, and execution—a capability only available with custom code. Because SaaS builders restrict this level of access, you are locked out of the most powerful tools for driving conversion and loyalty. By relying on basic, one-size-fits-all analytics, you are leaving significant money and customer goodwill on the table.5. The Seamless Switch: Migration Isn't the Nightmare You ImagineThe biggest fear holding brands back from a custom app is the migration process. The conventional wisdom says it will be a disruptive, risky, and resource-draining nightmare. This is flat-out wrong.A meticulously planned migration can be a zero-downtime event using a modern "Blue-Green Deployment Model," where the new system is built and tested in parallel before an instantaneous switchover.But here is the most critical—and surprising—truth: you can migrate your entire existing push notification subscriber base. Enterprise-grade messaging providers like Klaviyo and MoEngage provide dedicated Bulk Import APIs, allowing developers to securely transfer every push token to the new system. This preserves your most valuable communication channel without missing a beat. Finally, the new custom app is submitted to the app stores using the exact same App ID as the old one. For your existing users, the switch appears as a simple, seamless update, preserving all your hard-earned app store ratings and history.Conclusion: From Renter to OwnerMoving from a SaaS app builder to a custom application is not just a technical upgrade; it's a strategic business decision to transition from being a technology 'renter' to a technology 'owner'. This pivotal move unlocks superior long-term financial returns, breaks through the revenue ceilings imposed by third-party platforms, and builds a defensible, proprietary asset that becomes a core part of your company's value.Is your app builder a launchpad for your growth, or has it become a ceiling on your ambition?

Why Your SaaS App Builder Is a Ticking Time Bomb for Your Scaling Brand

Introduction: The Siren Song of SimplicityMobile app builders like Tapcart and Vajro present a powerful and legitimate value proposition for e-commerce brands: incredible speed to market and significantly lower initial costs. They can deliver a functional mobile app in just 2 to 8 weeks, compared to the 6 to 18 months required for a custom build, and do so for 60-80% less than the typical upfront investment. These platforms are an excellent way to validate the mobile channel and generate immediate ROI.However, for brands that find success and begin to scale, this initial advantage can quickly become a strategic liability. The very platforms that enable early growth contain hidden financial, technical, and strategic traps that can cripple a brand's long-term potential. This article uncovers the five most surprising and impactful reasons why scaling brands must "graduate" from these builders to a custom solution to avoid long-term damage.1. The Pilot Trap: Your Early Success Becomes a Long-Term PrisonThe "Pilot Trap" is a dynamic where the initial success and positive ROI from a builder-made app create so much operational momentum that it becomes strategically difficult to pause and rebuild. This success validates the mobile channel, which then makes the brand dependent on the builder's architecture. It’s a trap born from a deliberate business model: the brand's success is subtly leveraged by the builder to lock the brand into an inadequate long-term architecture, maximizing the vendor’s lifetime value.This transforms the brand's core mobile technology from a proprietary asset into a licensed operational overhead. The vendor benefits from the brand's success by securing a long-term, locked-in customer, maximizing their own lifetime value at the expense of the brand's strategic freedom.2. The Financial Reversal: "Cheaper" Becomes More Expensive Sooner Than You ThinkThe primary benefit of a builder—low cost—is an illusion over a 3- to 5-year strategic horizon. A sophisticated financial analysis reveals that the SaaS model’s Operational Expenditure (OPEX) is designed to scale inefficiently, while a custom build’s Capital Expenditure (CAPEX) creates a valuable, amortizable asset.Builders use aggressive tier structures to drive up expenses. Tapcart, for instance, begins with a CORE plan at $250/month but quickly escalates to an ULTIMATE plan at $500/month, reaching a high-tier subscription of $1,000/month.This is compounded by the "Success Penalty." High-volume plans, such as Vajro’s Plus tier (starting at $999/mo), introduce additional success fees after a brand reaches $100,000 per month in app sales. A portion of that success is taxed by the platform, directly eroding profit margins.In contrast, a custom solution, despite a high upfront CAPEX (40k−400k+), becomes a fully owned asset that is demonstrably more cost-effective by year three. Its predictable annual maintenance costs of only 8,000–12,000 stand in stark contrast to the endlessly escalating OPEX of a SaaS subscription. For a high-growth business, scaling OPEX this aggressively is financially inefficient.3. The Integration Tax: You're Paying a Premium to Work Around a Brittle SystemAs brands scale, they require deep, real-time integration with complex enterprise systems like ERP (Enterprise Resource Planning), PIM (Product Information Management), and WMS (Warehouse Management Systems). The standardized APIs offered by app builders struggle to handle these sophisticated, custom connections.This forces brands to pay an "Integration Tax." They must hire external agencies to build and maintain custom middleware just to bridge the gap between their core business systems and the builder's rigid architecture. This means the brand pays high, recurring costs for custom development work on top of the SaaS subscription fee.This approach not only adds significant expense but also introduces fragility and critical data consistency risks, such as overselling, stockouts, and inaccurate financial reports. The brand is forced to absorb the technical debt of the builder's architecture without gaining any of the benefits of ownership.4. The "Cookie-Cutter" Ceiling: Your Unique Brand Is Forced into a Standardized BoxThe drag-and-drop "block ecosystem" that makes builders easy to use is also their greatest weakness. This inherent rigidity leads to a "cookie-cutter" aesthetic that undermines a unique brand identity. But the limitation is more than skin-deep; it becomes a functional failure point for scaling brands.This rigidity fails in specific, critical areas:• Bespoke Logic: An inability to implement custom logic for features like complex subscription management funnels (e.g., specific constraints with ReCharge integration) or intricate loyalty tier displays with platforms like LoyaltyLion.• Global Commerce: Insufficient support for true global commerce. Tapcart, for instance, is limited to reflecting a Shopify store’s default currency, which is inadequate for brands needing dynamic, true multi-currency functionality, regional pricing strategies, and advanced localization features.Furthermore, many builders use hybrid solutions that can feel less polished or perform worse, especially on Android. This Native vs. Hybrid performance discrepancy means the time-to-market advantage of a builder is often paid for with a compromised user experience that damages brand perception and hurts conversion rates.5. The Valuation Drag: You Don't Own Your Code, and It's Killing Your Company's ValueThe most profound risk of using a SaaS builder is that the brand licenses the technology but does not own the intellectual property (IP) of the underlying code. This lack of ownership creates crippling vendor lock-in and becomes a catastrophic liability during fundraising or acquisition."A brand that does not own its source code is 'forever tied to the developer.' Any necessary modification, bug fix, or strategic upgrade must be routed through the vendor."This dependency is a major red flag during technical due diligence. Acquirers and investors see a technology stack built on a third-party platform not as an asset, but as a liability. This is "valuation drag"—the lack of proprietary IP actively depresses the company's potential exit valuation because an acquirer cannot independently refactor, migrate, guarantee maintenance, or integrate the technology stack.--------------------------------------------------------------------------------The Graduation Point: How to Know When to Make the MoveWhile builders are excellent launchpads, their financial, technical, and strategic limitations create clear thresholds for when a scaling brand must graduate to a custom-owned solution. The move should be initiated when one or more of the following triggers are crossed:1. The Financial Crossover: Your brand's annual aggregate licensing costs, success fees, and integration workarounds begin to exceed the projected annual maintenance cost of a fully owned application. For most, this occurs by year three.2. Integration Necessity: Your operations require deep, real-time synchronization with complex enterprise systems (ERP, PIM, WMS). This demand for tailored APIs has surpassed what the builder’s standardized architecture can reliably support.3. Feature Inflexibility: Your unique market position or product logic (e.g., configurators, subscription flows, global pricing) now exceeds the capabilities of the builder’s pre-defined blocks, forcing expensive and fragile workarounds.4. Strategic Intent: Your executive roadmap includes a capital fundraise or a potential acquisition, where proprietary, defensible technology and clean IP ownership are prerequisites for maximizing company valuation.Investing in a custom app isn't just an expense; it's the price of strategic freedom and building a defensible, valuable commerce engine.

The Myth of Migration Paralysis: How to Switch App Providers With Zero User Loss

As an e-commerce brand scales, it’s common to hit a “Hidden Ceiling” with standardized SaaS app builders like Tapcart or Vajro. The platform that once provided speed and simplicity now feels restrictive, where the standardized, multi-tenant architecture that once enabled speed now prevents the deep, custom integrations your unique business processes require. This feeling of being trapped often leads to high-anxiety searches like "Cancel Tapcart."The core fear behind this hesitation is the belief that switching providers means a disruptive re-launch. Merchants worry they will be forced to abandon their entire user base, lose their hard-won push notification subscribers, and start from scratch.This is a myth. A seamless, zero-loss migration is not only possible—it’s a necessary strategic upgrade for any brand ready to break through its growth ceiling. Here are the four surprising truths that make it possible.Your Biggest Fear Isn't Losing Features—It's Losing Your DataMany merchants feel paralyzed when they consider leaving their app provider. The deepest source of this anxiety isn't about features; it's about data sovereignty. This anxiety often stems from a startling discovery buried in the provider's terms of service: terminating your SaaS contract could lead to the deletion of your customer data, with the vendor having no liability for the loss, as per their own terms.The realization—that a core business asset (the customer profile database) is immediately vulnerable upon contract termination—is often the root cause of migration paralysis.Switching providers, therefore, is not just a technical choice. It is a strategic move to regain full control and ownership over one of your most valuable assets.You Can Migrate Every User Without a Single Password ResetA common migration nightmare is forcing your entire user base to reset their passwords, a move that guarantees massive churn. Modern security standards make it impossible to directly transfer encrypted passwords from one system to another. The solution, however, is an elegant strategy called "Just-In-Time" (JIT) migration.Here is how it works in simple terms:• When an existing user opens the new app for the first time and logs in, the system momentarily authenticates their old credentials against the old provider's API.• If the login is successful, the new system instantly and securely creates their account in the new database.• This entire process is invisible to the user. There are no password reset prompts and no friction—just a seamless login experience.Legal frameworks like GDPR’s "right to data portability" legally mandate that legacy providers cooperate with the export of non-sensitive data needed to make this process work. This solves one of the biggest sources of customer friction and directly preserves 100% of your existing user base.Your Most Valuable Marketing Channel Can Move With YouFor many brands, the push notification subscriber list is their most valuable owned marketing channel, sometimes driving up to 60% of their Direct-to-Consumer business. Losing this list during a migration would be an irrecoverable blow to marketing ROI. Fortunately, you don't have to.The technical components that enable push notifications—the push tokens for iOS and Android—can be securely exported from the old system. This is crucial because push tokens are highly volatile and can expire, making an active management strategy essential for channel viability. These tokens are then imported into a new, enterprise-grade marketing platform like Klaviyo or OneSignal and mapped to your user profiles.When the new version of your app is launched, it automatically "freshens" these tokens for each user who updates. This ensures your most powerful communication channel remains active and effective from day one, without having to rebuild your subscriber list from scratch.The "Big Switch" Is Invisible to Your UsersThe idea of a disruptive, public re-launch is a myth. A properly executed migration is completely invisible to your customers. The cornerstone of this zero-downtime process is ensuring your brand has administrative ownership of its Apple Developer and Google Play accounts. With that control, the "big switch" is nothing more than a standard version update.The new custom app is published to the existing app store listing, using the exact same App ID or Package Name, an incremented version number, and for Android, is signed with the identical security key as the previous version.For your users, the experience is routine. They see an available update in the App Store or Google Play. Their app icon stays in the same place on their phone, and all their saved ratings and history remain intact. The only change is that the updated app now communicates with your new, more powerful backend infrastructure. This process is de-risked even further by using a "staged rollout," where the update is first released to a small percentage (e.g., 1-5%) of users to monitor performance before a full, confident release.The Real Risk Is Standing StillA zero-downtime, zero-loss migration is not a chaotic technical project; it is a systematic, de-risked strategic upgrade. Once you understand that continuity is guaranteed, the decision framework shifts.The cost of inaction becomes the primary concern—the perpetual loss of revenue from lower performance. A custom app is an ROI-generating asset, achieving conversion rates 2x to 3x higher than mobile websites, driving a 10% to 30% increase in Average Order Value (AOV) through tailored upselling, and delivering superior user retention rates of up to 97.5% that directly maximize Lifetime Value (LTV).Now that a seamless migration is possible, what is the true cost of being constrained by your current platform?

The $5M Tipping Point: 5 Signs Your App Builder Has Become a Liability

1.0 Introduction: The Growth ParadoxFor a scaling Direct-to-Consumer (DTC) brand, speed is everything. You likely invested in a mobile app builder like Tapcart or Vajro to get to market fast, and it worked. You launched an app, started sending push notifications, and captured a valuable piece of customer real estate on their home screen.But as your brand grows and surpasses the $5 million Gross Merchandise Value (GMV) mark, a strange paradox emerges. The very tool that enabled your initial success begins to feel like a liability. The simplicity that once felt like an advantage now feels like a technical constraint. This is the "Hidden Ceiling"—a point where the builder's rigid architecture starts to limit your brand's potential.The decision facing high-growth brands is not a choice between app builders; it is a fundamental choice between two distinct business models: perpetual rental versus strategic ownership. This article deconstructs the hidden financial and technical liabilities of renting your mobile channel and provides a clear path to owning a core driver of your company's valuation.2.0 Takeaway 1: You're Not Just Renting an App, You're Renting a CeilingAs your brand scales, the strategic choice you face is not between different app builders. It is a fundamental decision between two entirely different business models: perpetual rental (SaaS builders) and strategic ownership (custom development).SaaS app builders are engineered for initial velocity. They get you launched quickly but at the cost of long-term control, brand differentiation, and technical scalability. This creates a "Hidden Ceiling" that constrains your ability to execute the unique digital experiences required to out-compete the market.High-growth brands must stop classifying their mobile app as a recurring operating expense (OpEx) and begin treating it as a capital investment in proprietary Intellectual Property (IP)—a core asset that drives long-term, defensible value.3.0 Takeaway 2: You Don't Actually Own Your App (And It Matters for Your Company's Value)One of the most critical details often overlooked in the fine print is about Intellectual Property (IP). When you use a SaaS app builder, your brand only owns its content, such as images and text. You do not own the core application itself.According to Tapcart’s own Terms of Use:A merchant has "no ownership or other property interest in any Merchant App" and "all rights in and to the Merchant Apps are and shall forever be owned by Tapcart."This is impactful for one simple reason: a SaaS license is a perpetual expense on your books. In contrast, a custom-built app is an ownable IP asset. This owned codebase contributes positively to your company's valuation during fundraising rounds or a future acquisition, making it a far more strategic long-term investment. During due diligence for fundraising or an acquisition, an owned codebase is a transferable asset on the balance sheet; a SaaS license is a perpetual liability that must be renegotiated or terminated.4.0 Takeaway 3: Your App Builder's "SaaS Tax" Is Designed to Punish Your SuccessThe financial model of SaaS app builders is counter-intuitive for scaling companies. As your needs become more complex with growth—requiring premium integrations or developer tools—you are forced into expensive Enterprise tiers. This is the "SaaS Tax."For example, Tapcart's Enterprise tier can cost $1,000 to 1,350ormorepermonth∗∗.Over three years,that accumulates to nearly∗∗48,600 in subscription fees alone. When factoring in mandatory setup fees and third-party app costs, the three-year Total Cost of Ownership (TCO) can easily approach or exceed the $72,000 benchmark cited in industry reports, all without building a single dollar of equity.This creates a "Cost Paradox of Success": the more successful your brand becomes, the higher its fixed, non-negotiable SaaS fees climb. You pay more without gaining any equity or true ownership in the technology. This stands in stark contrast to the predictable maintenance costs of a custom-built app, which typically run between 15-25% of the initial development cost annually.5.0 Takeaway 4: The "Custom" Features Are an Illusion That Deepens Lock-InApp builders often promote high-tier plans or developer tools as the solution to their platform's inherent rigidity. However, these features rarely solve the core problem and can actually deepen your reliance on the platform.Tapcart's "Custom Blocks" feature is a prime example. While it appears to offer a path to customization, it comes with two significant caveats:1. It requires a mandatory upgrade to the most expensive Enterprise tier.2. It forces your developers to code React-based components within Tapcart's proprietary, constrained architecture using their Command Line Interface (CLI), which is not a truly custom or portable environment.This creates a financial paradox: your brand pays a premium SaaS fee to Tapcart and pays developer salaries to build features that remain tethered to the platform. In essence, you are paying a premium to fund your own vendor lock-in, investing your development resources into features that ultimately increase the value of Tapcart's platform, not your own company's IP. Meanwhile, you remain unable to build the very features that drive differentiation and un-cap revenue potential—from bespoke product configurators and advanced search logic to customized re-ordering experiences on high-intent pages like the PDP and account dashboard.Conclusion: From Perpetual Renter to Strategic OwnerFor brands scaling beyond the $5 million GMV mark, the strategic goal must evolve. For brands aiming for market leadership and eventual enterprise valuation, graduating from a builder is not merely an alternative—it is a necessary strategic step to un-cap growth and build defensible enterprise value.While the fear of migrating—"Switcher Anxiety"—is understandable, it is a solved technical challenge. Modern agencies use zero-downtime 'Blue-Green' deployment strategies and can preserve your push notification subscribers from platforms like Klaviyo, ensuring a seamless transition that is far less risky than staying on a platform that actively limits your growth.Ultimately, you must ask yourself a critical question about your most important mobile channel.Is your mobile app an asset that builds your company's value, or an operating expense that limits its future?