The $5M Tipping Point: 5 Signs Your App Builder Has Become a Liability

Part of the Is Your App Builder Holding Your Brand Hostage? 5 Counter-Intuitive Truths series.

1.0 Introduction: The Growth Paradox

For a scaling Direct-to-Consumer (DTC) brand, speed is everything. You likely invested in a mobile app builder like Tapcart or Vajro to get to market fast, and it worked. You launched an app, started sending push notifications, and captured a valuable piece of customer real estate on their home screen.

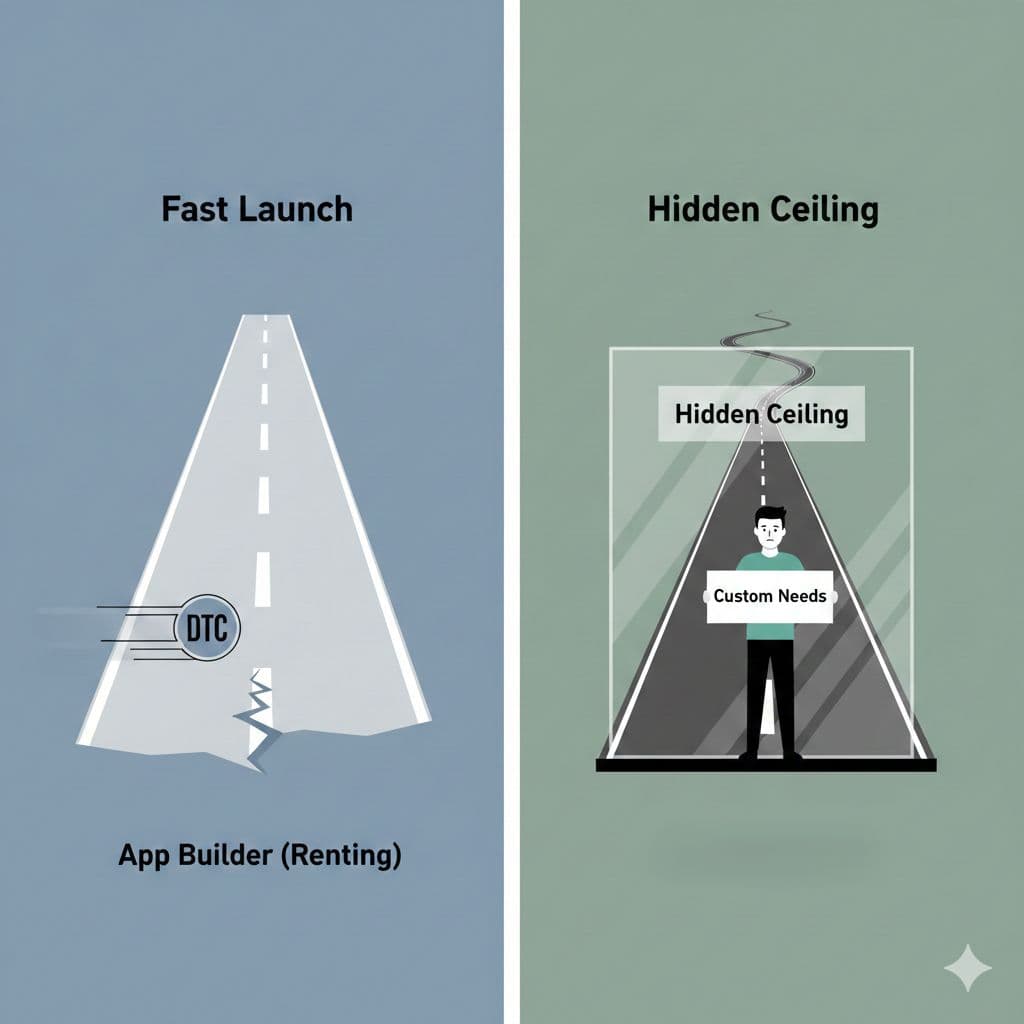

But as your brand grows and surpasses the $5 million Gross Merchandise Value (GMV) mark, a strange paradox emerges. The very tool that enabled your initial success begins to feel like a liability. The simplicity that once felt like an advantage now feels like a technical constraint. This is the "Hidden Ceiling"—a point where the builder's rigid architecture starts to limit your brand's potential.

The decision facing high-growth brands is not a choice between app builders; it is a fundamental choice between two distinct business models: perpetual rental versus strategic ownership. This article deconstructs the hidden financial and technical liabilities of renting your mobile channel and provides a clear path to owning a core driver of your company's valuation.

2.0 Takeaway 1: You're Not Just Renting an App, You're Renting a Ceiling

As your brand scales, the strategic choice you face is not between different app builders. It is a fundamental decision between two entirely different business models: perpetual rental (SaaS builders) and strategic ownership (custom development).

SaaS app builders are engineered for initial velocity. They get you launched quickly but at the cost of long-term control, brand differentiation, and technical scalability. This creates a "Hidden Ceiling" that constrains your ability to execute the unique digital experiences required to out-compete the market.

High-growth brands must stop classifying their mobile app as a recurring operating expense (OpEx) and begin treating it as a capital investment in proprietary Intellectual Property (IP)—a core asset that drives long-term, defensible value.

3.0 Takeaway 2: You Don't Actually Own Your App (And It Matters for Your Company's Value)

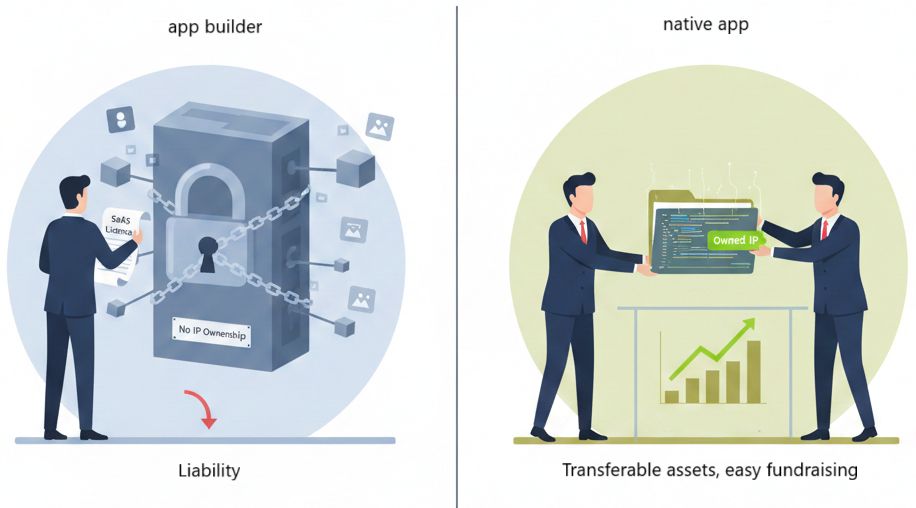

One of the most critical details often overlooked in the fine print is about Intellectual Property (IP). When you use a SaaS app builder, your brand only owns its content, such as images and text. You do not own the core application itself.

According to Tapcart’s own Terms of Use:

A merchant has "no ownership or other property interest in any Merchant App" and "all rights in and to the Merchant Apps are and shall forever be owned by Tapcart."

This is impactful for one simple reason: a SaaS license is a perpetual expense on your books. In contrast, a custom-built app is an ownable IP asset. This owned codebase contributes positively to your company's valuation during fundraising rounds or a future acquisition, making it a far more strategic long-term investment. During due diligence for fundraising or an acquisition, an owned codebase is a transferable asset on the balance sheet; a SaaS license is a perpetual liability that must be renegotiated or terminated.

4.0 Takeaway 3: Your App Builder's "SaaS Tax" Is Designed to Punish Your Success

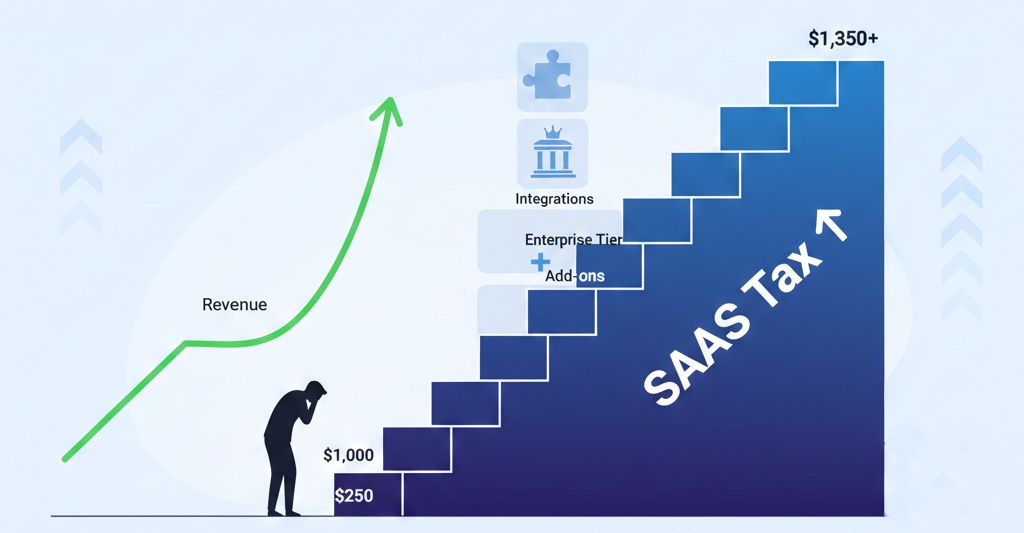

The financial model of SaaS app builders is counter-intuitive for scaling companies. As your needs become more complex with growth—requiring premium integrations or developer tools—you are forced into expensive Enterprise tiers. This is the "SaaS Tax."

For example, Tapcart's Enterprise tier can cost $1,000 to 1,350ormorepermonth∗∗.Over three years,that accumulates to nearly∗∗48,600 in subscription fees alone. When factoring in mandatory setup fees and third-party app costs, the three-year Total Cost of Ownership (TCO) can easily approach or exceed the $72,000 benchmark cited in industry reports, all without building a single dollar of equity.

This creates a "Cost Paradox of Success": the more successful your brand becomes, the higher its fixed, non-negotiable SaaS fees climb. You pay more without gaining any equity or true ownership in the technology. This stands in stark contrast to the predictable maintenance costs of a custom-built app, which typically run between 15-25% of the initial development cost annually.

5.0 Takeaway 4: The "Custom" Features Are an Illusion That Deepens Lock-In

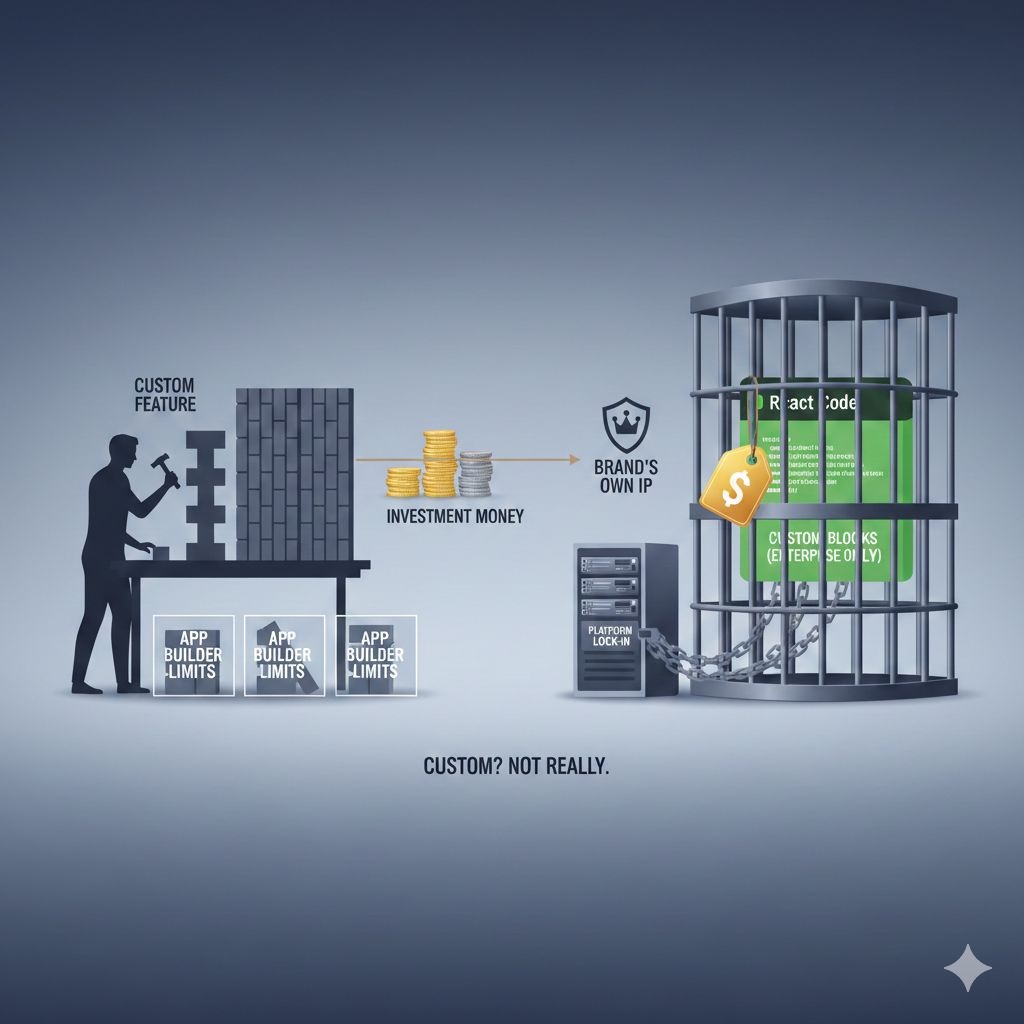

App builders often promote high-tier plans or developer tools as the solution to their platform's inherent rigidity. However, these features rarely solve the core problem and can actually deepen your reliance on the platform.

Tapcart's "Custom Blocks" feature is a prime example. While it appears to offer a path to customization, it comes with two significant caveats:

1. It requires a mandatory upgrade to the most expensive Enterprise tier.

2. It forces your developers to code React-based components within Tapcart's proprietary, constrained architecture using their Command Line Interface (CLI), which is not a truly custom or portable environment.

This creates a financial paradox: your brand pays a premium SaaS fee to Tapcart and pays developer salaries to build features that remain tethered to the platform. In essence, you are paying a premium to fund your own vendor lock-in, investing your development resources into features that ultimately increase the value of Tapcart's platform, not your own company's IP. Meanwhile, you remain unable to build the very features that drive differentiation and un-cap revenue potential—from bespoke product configurators and advanced search logic to customized re-ordering experiences on high-intent pages like the PDP and account dashboard.

Conclusion: From Perpetual Renter to Strategic Owner

For brands scaling beyond the $5 million GMV mark, the strategic goal must evolve. For brands aiming for market leadership and eventual enterprise valuation, graduating from a builder is not merely an alternative—it is a necessary strategic step to un-cap growth and build defensible enterprise value.

While the fear of migrating—"Switcher Anxiety"—is understandable, it is a solved technical challenge. Modern agencies use zero-downtime 'Blue-Green' deployment strategies and can preserve your push notification subscribers from platforms like Klaviyo, ensuring a seamless transition that is far less risky than staying on a platform that actively limits your growth.

Ultimately, you must ask yourself a critical question about your most important mobile channel.

Is your mobile app an asset that builds your company's value, or an operating expense that limits its future?