Your SaaS App Isn't an Asset, It's a Liability: The Valuation Mistake Costing Founders Their Exit

Part of the Is Your App Builder Holding Your Brand Hostage? 5 Counter-Intuitive Truths series.

1.0 Introduction: The Scaling E-commerce Dilemma

For fast-growing e-commerce brands, the conventional wisdom is clear: SaaS mobile app builders offer a fast, seemingly low-cost entry into the mobile channel. They promise speed and convenience, making them an appealing first step for any brand looking to engage its customers on their phones.

However, a counter-intuitive reality emerges for high-growth brands, especially those scaling past the $5 million GMV mark. This conventional path can quickly become a strategic trap, creating severe financial and valuation consequences that are often overlooked until it's too late.

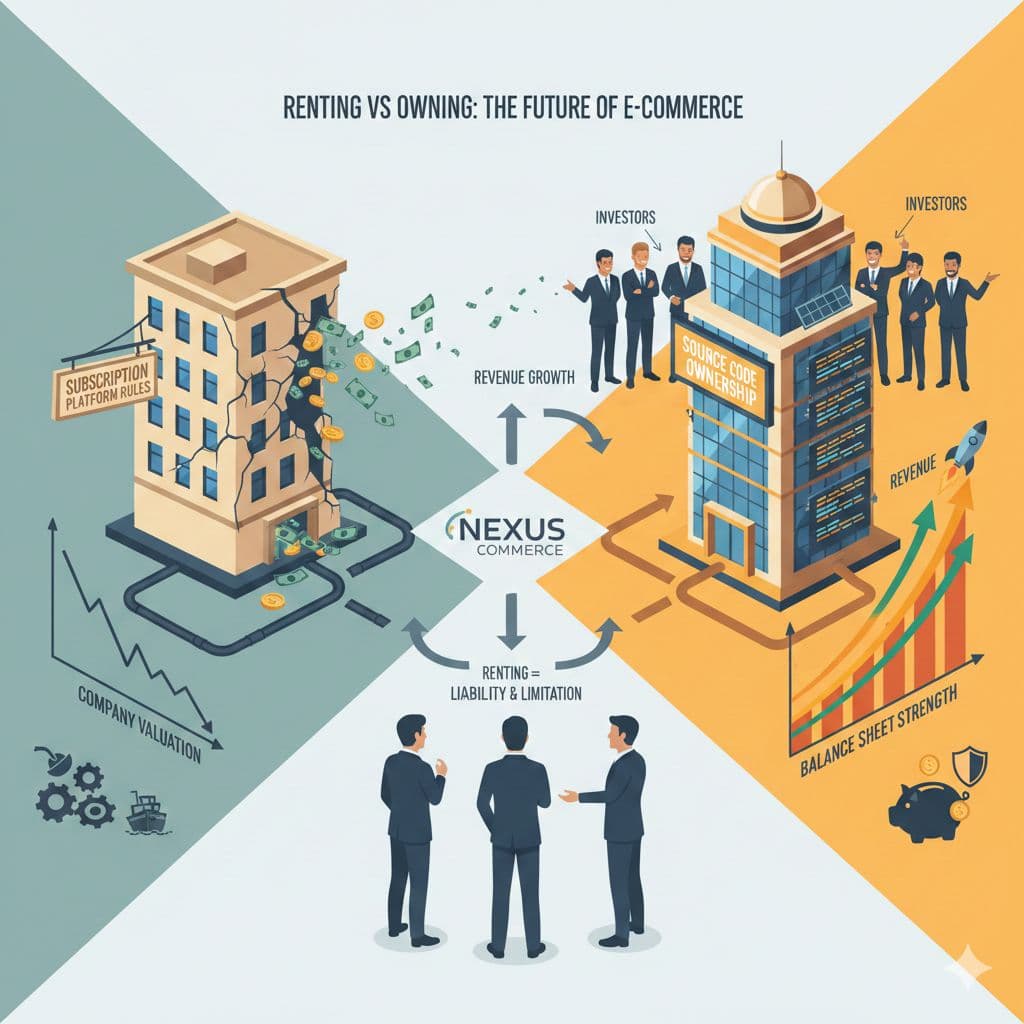

This article reveals the most surprising and impactful reasons why owning your app's code is not just a technical detail but a critical strategic decision for long-term value creation and a successful future exit. We will explore how the choice to "rent" versus "own" your mobile app directly impacts your company's balance sheet, its attractiveness to investors, and its ultimate sale price.

2.0 Takeaway 1: Your App Isn't a Monthly Bill—It's a Capital Asset

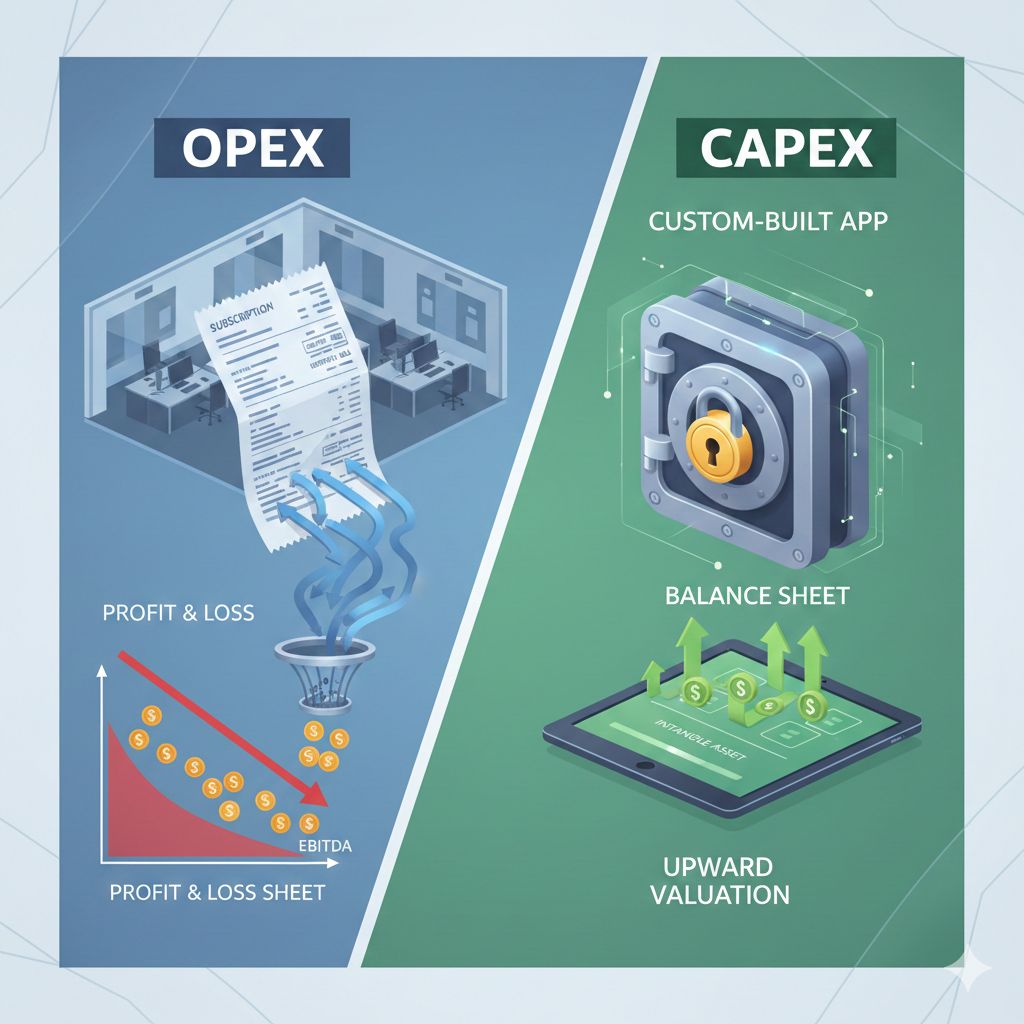

The most fundamental difference between using a SaaS app builder and commissioning a custom build lies in how the expense is treated on your financial statements. This isn't just accounting jargon; it's a distinction that dramatically alters how investors and acquirers perceive the value of your business.

A SaaS app subscription is an Operating Expense (OPEX). It's a recurring cost that hits your profit and loss statement every month, directly reducing your reported earnings (EBITDA). Functionally, it's no different than renting an office—you pay for access, but you build no equity.

A custom-built app where you own the code is a Capital Expenditure (CAPEX). This strategic investment is classified as a proprietary, Intangible Asset on your company's balance sheet. The cost can be amortized over its useful life, smoothing the expense over several years instead of taking a monthly hit to profitability.

Treating your app as a capitalized asset improves key profitability metrics and signals a commitment to building long-term, transferable value. This is a powerful demonstration of strategic foresight that is highly attractive to investors and helps justify a higher valuation multiple.

A technology company with high recurring OPEX due to significant platform licensing fees may present a lower EBITDA, potentially resulting in a suppressed revenue multiple during acquisition. Conversely, a company that has actively invested in and capitalized its core technology asset demonstrates commitment to long-term, transferable value creation, justifying a higher technology multiple.

3.0 Takeaway 2: You're Accidentally Sabotaging Your Company's Future Sale

During a Mergers & Acquisitions (M&A) process, potential buyers conduct rigorous IP due diligence. One of their primary goals is to verify clear and undisputed ownership of all critical technology assets. This process revolves around the "chain of title" for your source code. If you cannot provide a clear, documented history that proves you unequivocally own the code your app runs on, it is a primary "deal-breaker" for acquirers. They need to know they are buying an asset, not a liability.

This is where SaaS builders introduce a massive, often unforeseen, risk. A buyer isn't acquiring a proprietary asset you built; they are acquiring dependency on a third-party vendor they cannot control. This "vendor lock-in" is viewed as a major proprietary risk that directly leads to a reduced valuation. The buyer is essentially purchasing a revenue stream that is contingent on a relationship with another company, exposing them to future price hikes, service changes, a decline in quality, or even the catastrophic risk of the vendor going out of business entirely.

Furthermore, SaaS platforms obscure a critical legal risk: open-source license compliance. Acquirers performing deep technical diligence will look for "copyleft" licenses that could legally compel you to release your proprietary code. An owned app allows you to meticulously manage this exposure; a SaaS app presents a black box, creating a potential legal time bomb that can detonate a deal.

The severe consequence is that a scaling brand might believe it's building a valuable asset, but by using a SaaS platform, it is actually introducing a fundamental risk that could lead to a significantly reduced offer or kill a potential acquisition deal entirely.

4.0 Takeaway 3: The "Convenience" of No-Code Comes with a Hidden Performance Penalty

No-code and low-code platforms build applications using generalized, pre-built components. They are designed to work for everyone, which means they are not optimized for anyone's specific needs. This generalized approach results in "bloated code." In simple terms, your app is forced to carry extra, unnecessary code for features and functions it doesn't even use. This unnecessary baggage makes the application heavier, slower, and more prone to performance issues.

This technical problem has direct and severe business consequences:

• Slower performance and delayed loading times lead to user frustration.

• A higher probability of crashes damages brand credibility.

• Poor user experience increases cart abandonment and decreases customer retention.

The irony is that the initial time and money saved with a SaaS builder are often completely nullified by the persistent negative drag on crucial revenue metrics like Customer Lifetime Value (LTV)—the very metrics that potential acquirers scrutinize most intensely. This persistent drag on user experience not only erodes revenue directly but also creates a hidden operational tax, forcing teams into costly manual workarounds to compensate for the platform's shortcomings.

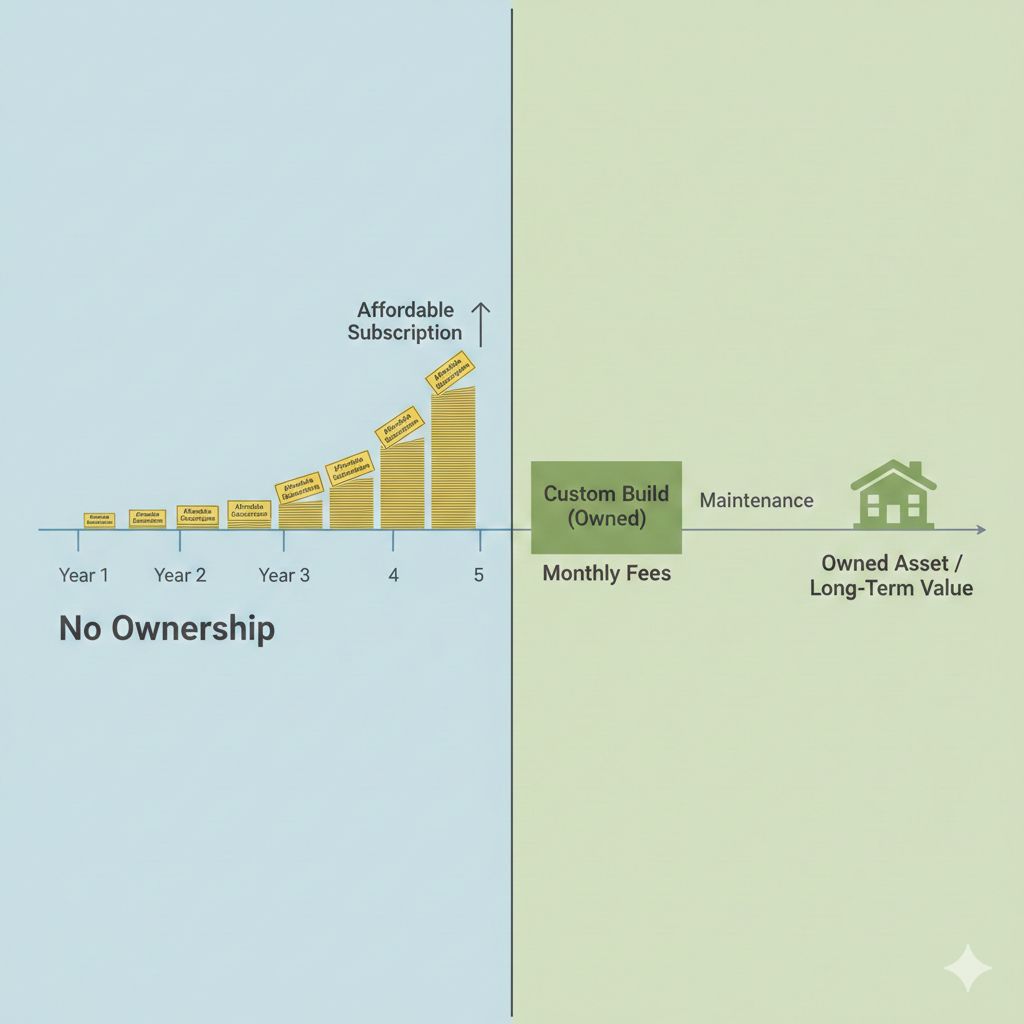

5.0 Takeaway 4: Your "Affordable" Subscription Has Hidden Costs That Compound Over Time

The low upfront cost of a SaaS subscription is its main appeal, but this view is dangerously shortsighted. A proper Total Cost of Ownership (TCO) analysis over a 3-to-5-year period often reveals a different financial reality. For scaling brands, the cumulative cost of high-tier SaaS subscriptions, which can start at 1,000–1,199 or more per month, frequently surpasses the investment for a custom build.

Consider this concrete 5-year financial model:

• Custom Build: A 150,000CAPEX∗∗investmenttocreateaproprietaryasset,plusapredictable∗∗30,000 annually for maintenance (20% of build cost).

• SaaS Builder: A $14,400 annual OPEX subscription fee.

Over five years, the SaaS subscription totals 72,000∗∗inpurerentalfees,creatingzerobookvalue.Thecustombuildhasa5−yearTCOof∗∗300,000, but this is not a simple comparison. The $300,000 investment yields a capitalizable, transferable, high-ROI asset that increases your company's valuation—an asset you own outright. The $72,000 yields nothing but a receipt for services rendered.

The SaaS price also hides compounding costs like subscription creep—unavoidable price hikes as you scale—and operational drag, the real cost in staff wages and inefficiency spent creating manual workarounds for features the platform doesn't support. In contrast, a custom app's maintenance budget is a managed investment in preserving and enhancing a strategic asset that you own and control.

Conclusion: Are You Building Value or Just Renting It?

The decision is not merely about budgets; it is a choice between building strategic independence or accepting perpetual vendor lock-in. For founders focused on maximizing their exit, an owned, proprietary app is not an expense—it is the purchase of the highest possible valuation multiplier in the technology acquisition market.

While SaaS builders offer a convenient on-ramp, they transform your technology into an operational liability characterized by limited differentiation, unmitigated M&A risk, and zero IP defensibility. The only path to maximizing shareholder return is through the creation of a capitalizable asset that guarantees strategic control and unlimited feature velocity. As you plan your company's future, you must ask a critical question:

Is your mobile app building your company's long-term value, or is it just building your vendor's?