Why Your SaaS App Builder Is a Ticking Time Bomb for Your Scaling Brand

Part of the Is Your App Builder Holding Your Brand Hostage? 5 Counter-Intuitive Truths series.

Introduction: The Siren Song of Simplicity

Mobile app builders like Tapcart and Vajro present a powerful and legitimate value proposition for e-commerce brands: incredible speed to market and significantly lower initial costs. They can deliver a functional mobile app in just 2 to 8 weeks, compared to the 6 to 18 months required for a custom build, and do so for 60-80% less than the typical upfront investment. These platforms are an excellent way to validate the mobile channel and generate immediate ROI.

However, for brands that find success and begin to scale, this initial advantage can quickly become a strategic liability. The very platforms that enable early growth contain hidden financial, technical, and strategic traps that can cripple a brand's long-term potential. This article uncovers the five most surprising and impactful reasons why scaling brands must "graduate" from these builders to a custom solution to avoid long-term damage.

1. The Pilot Trap: Your Early Success Becomes a Long-Term Prison

The "Pilot Trap" is a dynamic where the initial success and positive ROI from a builder-made app create so much operational momentum that it becomes strategically difficult to pause and rebuild. This success validates the mobile channel, which then makes the brand dependent on the builder's architecture. It’s a trap born from a deliberate business model: the brand's success is subtly leveraged by the builder to lock the brand into an inadequate long-term architecture, maximizing the vendor’s lifetime value.

This transforms the brand's core mobile technology from a proprietary asset into a licensed operational overhead. The vendor benefits from the brand's success by securing a long-term, locked-in customer, maximizing their own lifetime value at the expense of the brand's strategic freedom.

2. The Financial Reversal: "Cheaper" Becomes More Expensive Sooner Than You Think

The primary benefit of a builder—low cost—is an illusion over a 3- to 5-year strategic horizon. A sophisticated financial analysis reveals that the SaaS model’s Operational Expenditure (OPEX) is designed to scale inefficiently, while a custom build’s Capital Expenditure (CAPEX) creates a valuable, amortizable asset.

Builders use aggressive tier structures to drive up expenses. Tapcart, for instance, begins with a CORE plan at $250/month but quickly escalates to an ULTIMATE plan at $500/month, reaching a high-tier subscription of $1,000/month.

This is compounded by the "Success Penalty." High-volume plans, such as Vajro’s Plus tier (starting at $999/mo), introduce additional success fees after a brand reaches $100,000 per month in app sales. A portion of that success is taxed by the platform, directly eroding profit margins.

In contrast, a custom solution, despite a high upfront CAPEX (40k−400k+), becomes a fully owned asset that is demonstrably more cost-effective by year three. Its predictable annual maintenance costs of only 8,000–12,000 stand in stark contrast to the endlessly escalating OPEX of a SaaS subscription. For a high-growth business, scaling OPEX this aggressively is financially inefficient.

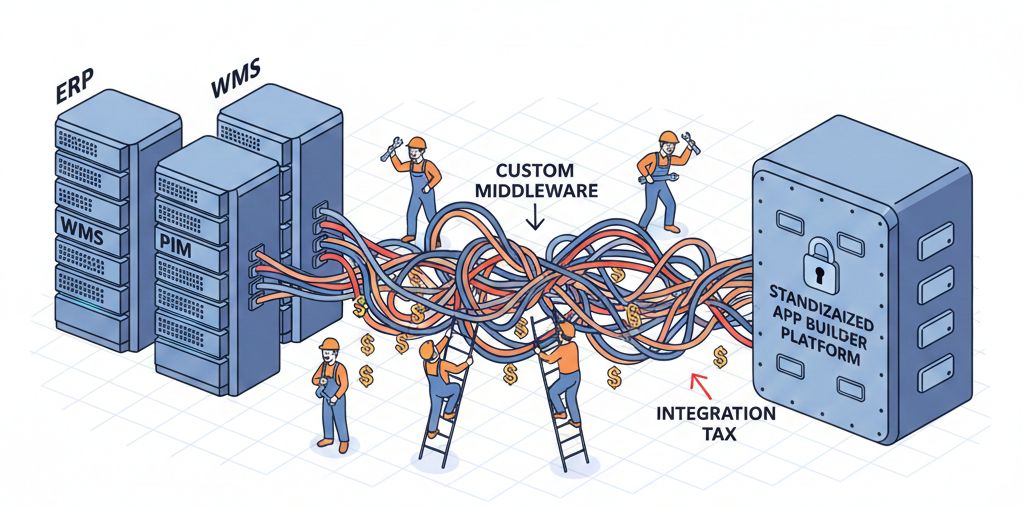

3. The Integration Tax: You're Paying a Premium to Work Around a Brittle System

As brands scale, they require deep, real-time integration with complex enterprise systems like ERP (Enterprise Resource Planning), PIM (Product Information Management), and WMS (Warehouse Management Systems). The standardized APIs offered by app builders struggle to handle these sophisticated, custom connections.

This forces brands to pay an "Integration Tax." They must hire external agencies to build and maintain custom middleware just to bridge the gap between their core business systems and the builder's rigid architecture. This means the brand pays high, recurring costs for custom development work on top of the SaaS subscription fee.

This approach not only adds significant expense but also introduces fragility and critical data consistency risks, such as overselling, stockouts, and inaccurate financial reports. The brand is forced to absorb the technical debt of the builder's architecture without gaining any of the benefits of ownership.

4. The "Cookie-Cutter" Ceiling: Your Unique Brand Is Forced into a Standardized Box

The drag-and-drop "block ecosystem" that makes builders easy to use is also their greatest weakness. This inherent rigidity leads to a "cookie-cutter" aesthetic that undermines a unique brand identity. But the limitation is more than skin-deep; it becomes a functional failure point for scaling brands.

This rigidity fails in specific, critical areas:

• Bespoke Logic: An inability to implement custom logic for features like complex subscription management funnels (e.g., specific constraints with ReCharge integration) or intricate loyalty tier displays with platforms like LoyaltyLion.

• Global Commerce: Insufficient support for true global commerce. Tapcart, for instance, is limited to reflecting a Shopify store’s default currency, which is inadequate for brands needing dynamic, true multi-currency functionality, regional pricing strategies, and advanced localization features.

Furthermore, many builders use hybrid solutions that can feel less polished or perform worse, especially on Android. This Native vs. Hybrid performance discrepancy means the time-to-market advantage of a builder is often paid for with a compromised user experience that damages brand perception and hurts conversion rates.

5. The Valuation Drag: You Don't Own Your Code, and It's Killing Your Company's Value

The most profound risk of using a SaaS builder is that the brand licenses the technology but does not own the intellectual property (IP) of the underlying code. This lack of ownership creates crippling vendor lock-in and becomes a catastrophic liability during fundraising or acquisition.

"A brand that does not own its source code is 'forever tied to the developer.' Any necessary modification, bug fix, or strategic upgrade must be routed through the vendor."

This dependency is a major red flag during technical due diligence. Acquirers and investors see a technology stack built on a third-party platform not as an asset, but as a liability. This is "valuation drag"—the lack of proprietary IP actively depresses the company's potential exit valuation because an acquirer cannot independently refactor, migrate, guarantee maintenance, or integrate the technology stack.

--------------------------------------------------------------------------------

The Graduation Point: How to Know When to Make the Move

While builders are excellent launchpads, their financial, technical, and strategic limitations create clear thresholds for when a scaling brand must graduate to a custom-owned solution. The move should be initiated when one or more of the following triggers are crossed:

1. The Financial Crossover: Your brand's annual aggregate licensing costs, success fees, and integration workarounds begin to exceed the projected annual maintenance cost of a fully owned application. For most, this occurs by year three.

2. Integration Necessity: Your operations require deep, real-time synchronization with complex enterprise systems (ERP, PIM, WMS). This demand for tailored APIs has surpassed what the builder’s standardized architecture can reliably support.

3. Feature Inflexibility: Your unique market position or product logic (e.g., configurators, subscription flows, global pricing) now exceeds the capabilities of the builder’s pre-defined blocks, forcing expensive and fragile workarounds.

4. Strategic Intent: Your executive roadmap includes a capital fundraise or a potential acquisition, where proprietary, defensible technology and clean IP ownership are prerequisites for maximizing company valuation.

Investing in a custom app isn't just an expense; it's the price of strategic freedom and building a defensible, valuable commerce engine.