The CAC Crisis: Why a Native App Is the Non-Negotiable LTV Engine for Beauty Brands

Part of the Vertical Specialization Drives 3X Higher Conversions series.

Introduction: The Leaky Bucket of Digital Beauty

If you run an e-commerce beauty brand, you're likely feeling the pressure. The old playbook—fueling growth with cheap, targeted social media ads—is broken. Customer Acquisition Costs (CAC) have soared, and privacy changes have made it harder than ever to reach the right audience. You're spending more to acquire each new customer, but they're leaving just as fast.

This is the "leaky bucket" problem. Brands pour money into the top of the funnel, only to watch customers churn out the bottom after a single purchase. The solution isn't just better ad creative or a bigger budget. It's a fundamental shift in the customer relationship, and the most powerful tool for this transformation is found right on your customer's home screen: a native mobile app.

1. The New Math: Your First Sale Is Now a Financial Loss

The economic reality for direct-to-consumer beauty brands has become brutally simple. For the past decade, the DTC model was built on an arbitrage opportunity: buying attention cheaply on social platforms and converting it to profit. That arbitrage window has definitively closed. The cost to acquire a new customer through paid channels is now between $55 and $85. This single data point changes everything. When your Customer Acquisition Cost is higher than the Average Order Value (AOV) of a first purchase, your business model is mathematically insolvent on the first transaction.

Profitability is no longer possible on the first sale; it is entirely dependent on securing a second, third, and fourth purchase. This deferral of profit exposes a critical vulnerability. The financial exposure is severe, as the source report bluntly illustrates:

When a brand pays $70 to acquire a customer who buys a $50 cream and never returns, the brand has essentially paid $20 for the privilege of shipping product.

This unforgiving math makes customer retention the single most important metric for survival. Your focus must shift from simply acquiring customers to engineering loyalty and maximizing Lifetime Value (LTV).

2. Digital Real Estate: Your App Icon is a Subliminal Billboard

Think about the prime real estate on your phone's home screen. A mobile app gives your brand a permanent, owned presence in your customer's most personal digital space. This is more than just a convenient link; it's a powerful psychological anchor.

Behavioral economics calls this the "Endowment Effect"—we value something more highly simply because we "own" it. By downloading your app, a customer has psychologically endowed themselves with your brand. It becomes their beauty destination. This creates what can be called "Real Estate Dominance." With the average user unlocking their phone 80-100 times a day, your brand's icon serves as a constant, subliminal advertisement. Every time they unlock their device, they see your logo, reinforcing brand recall in a way a mobile website bookmark could never replicate.

This power is amplified by "Ritual Alignment." For an industry built on daily habits, an app integrates your brand into the user's ritualistic lifestyle, transforming a transactional relationship into a utility-based one.

3. The Performance Chasm: Apps Don't Just Convert Better, They Convert 4x Better

The performance gap between a mobile website and a native app is not marginal; it is structural, delivering a 3x to 4x multiplier in conversion efficiency. The data reveals a clear and undeniable chasm in user behavior and commercial outcomes.

| Performance Metric => | Browser | Mobile App |

| Conversion Rate => | 1.5% – 3.0% | 6.0% – 12.0% |

| Add-to-Cart Rate => | 5% – 8% | 15% – 20% |

| Products Viewed => | 4.2 per Session | 16.5 per Session |

| Retention Rate => | <30% | 50% – 60%+ |

This massive performance lift is driven by a superior, frictionless user experience. Native apps leverage the device's hardware for instant load times and one-tap biometric checkout. In a visually-driven industry like beauty, this is critical. Crucially, the dramatic increase in retention shows how the app environment structurally fosters loyalty and anchors the brand in a user's daily routine, directly combating the "leaky bucket" problem.

4. The Smartest Sales Trigger: Predicting the "Empty Bottle"

For beauty brands selling consumable products, the most powerful trigger for a repeat purchase is the moment a customer is about to run out. A sophisticated mobile app can turn this moment into an automated, revenue-driving event through algorithmic replenishment.

The mechanism is simple yet powerful: the app analyzes a user's purchase history to predict when a product, like a 45-day moisturizer, will be empty. This is the "Time-to-Empty" prediction. The app then triggers a perfectly timed push notification. For example, on Day 40 of a 45-day product cycle, the app sends a message: "Running low on Cloud Cream? Restock now to receive it by Friday."

This is a game-changer because it captures the reorder before the customer enters the 'consideration phase' for a competitor's product, effectively locking in the LTV.

A reminder that "Your Vitamin C serum should be running low" is perceived as a helpful service rather than an intrusive ad, provided the timing is algorithmic and personalized.

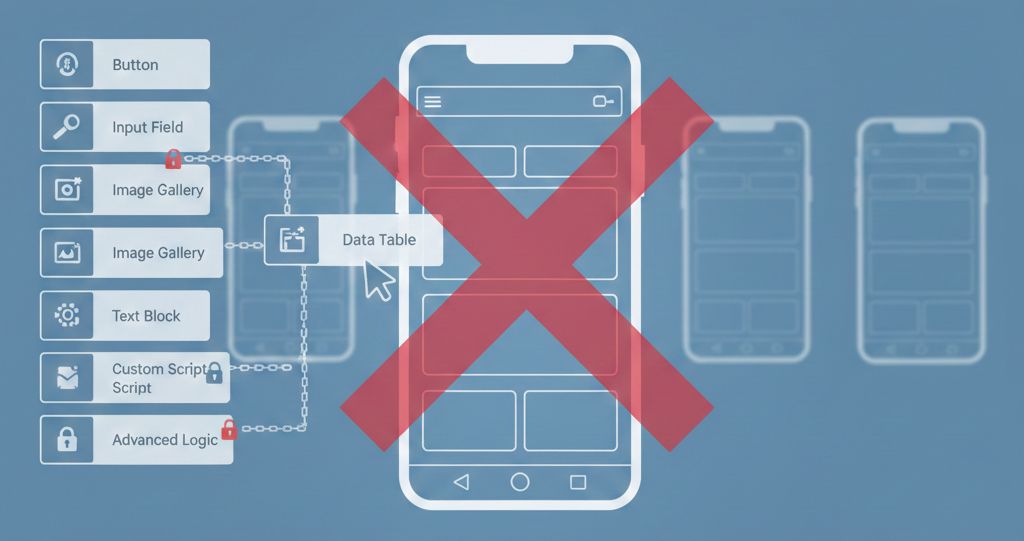

5. The "No-Code" Trap: Why the Easy App Solution Can Strangle Growth

The rise of "no-code" app builders has made it easier than ever to launch an app. While these platforms have democratized access, for ambitious brands they often act as a "stranglehold on growth."

The primary drawback is the Homogenization of UX. Template-based apps look and feel identical. In an industry where brand aesthetic is a key differentiator, this cookie-cutter approach dilutes brand equity.

Furthermore, scaling brands often suffer from Integration Rigidities. These platforms frequently fail to support the complex or custom logic that drives growth, such as advanced product bundles, niche loyalty programs, or server-side personalization.

To solve this, builders offer the "'Custom Blocks' Fallacy." While they allow developers to inject custom code, these blocks are often sandboxed and unable to interact with core app logic. This negates the "no-code" promise by requiring developer resources anyway, all while keeping the brand trapped in a rented architecture. Finally, over a three-year horizon, the total cost of a rented SaaS app can exceed a custom build, leaving the brand with no intellectual property.

--------------------------------------------------------------------------------

Conclusion: Are You Building a Brand or Just Renting Customers?

In the face of the CAC crisis, simply pouring more money into advertising is no longer a viable strategy. Profitability is now a direct function of retention, and retention is a function of habit. The native mobile app is the essential "LTV Engine" capable of engineering those habits.

It transforms the customer relationship from a series of isolated transactions into a continuous, personalized dialogue. It turns a "customer" into a "subscriber," and a "browser" into a "brand advocate." While generic app builders offer a quick start, they ultimately limit your ability to create a truly differentiated experience. An owned, custom solution provides the flexibility and power to build a proprietary retention ecosystem that can grow with you.

As you plan your next fiscal year, the critical question is no longer if you need an app, but whether you will invest in an owned asset that builds enterprise value, or continue renting a commoditized channel that limits it?