Renting vs. Owning Your App: 4 Surprising Truths About the Real Cost of Mobile App Builders

Part of the Think Mobile Apps Are a Luxury? Here's the Data That Proves They're a Financial Necessity series.

1. Introduction: The Hidden Price of "Easy"

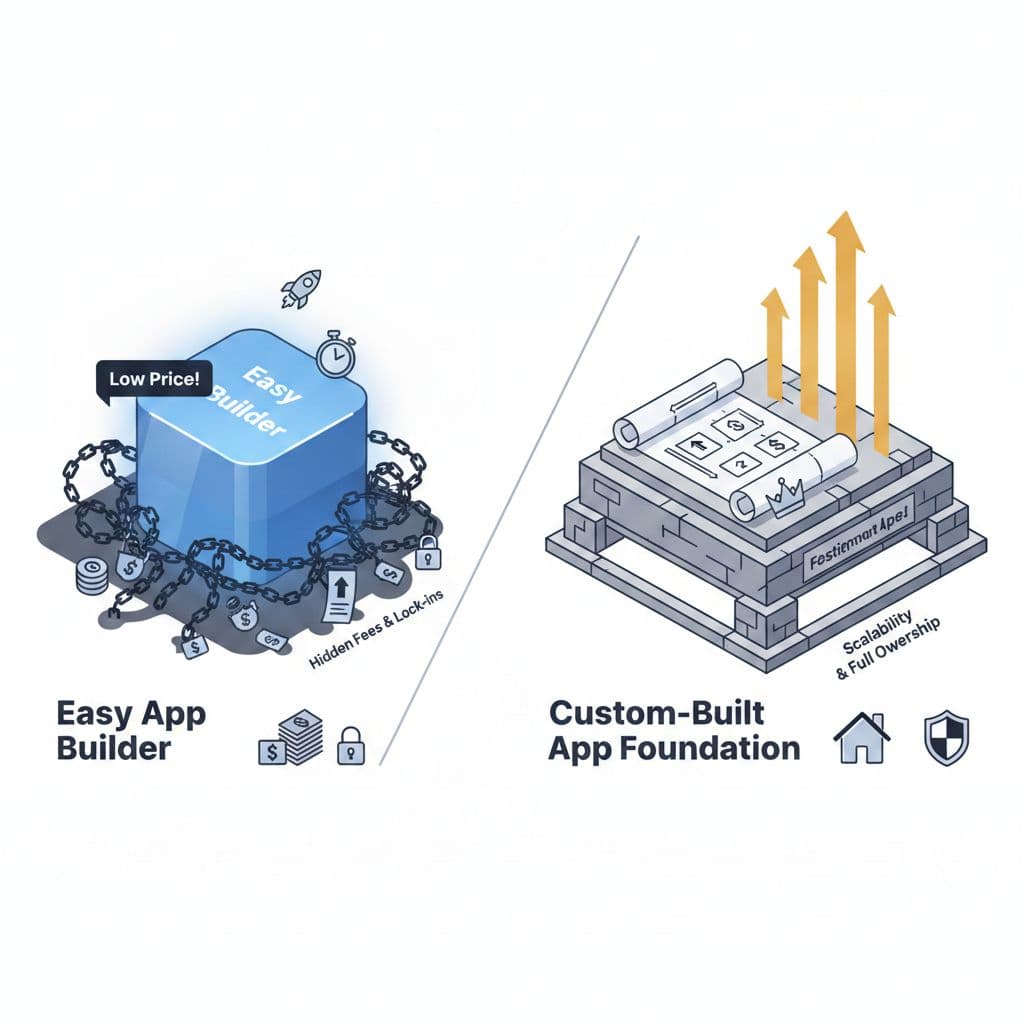

For any growing business, launching a mobile app is a major strategic goal. The immediate appeal of low-cost, template-based SaaS app builders is undeniable—they promise speed, simplicity, and a low monthly fee. However, this initial price tag is dangerously misleading. The choice is a critical financial decision where focusing on the upfront cost ignores the long-term Total Cost of Ownership (TCO). This article reveals the surprising truths that can make the "cheaper" rental option a far more expensive and strategically restrictive path for any business serious about growth.

2. Takeaway 1: You're Being Taxed for Your Own Success

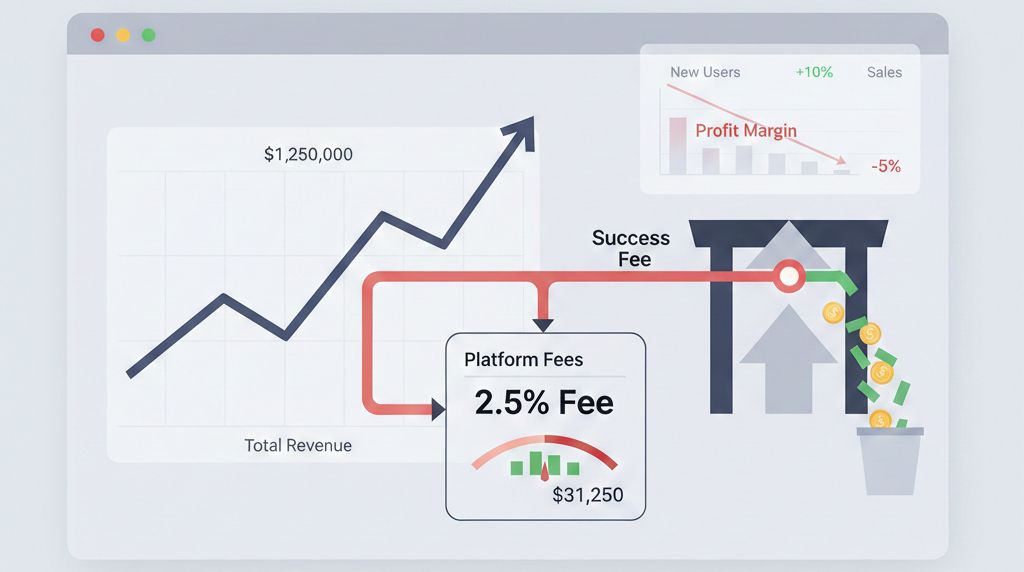

Many SaaS platforms impose a "success fee," a variable cost calculated as a percentage of your app's revenue (typically 1.75% to 2.5%) that functions as a direct tax on your growth. This fee is charged on top of your fixed monthly subscription, creating a fundamental conflict of interest: the platform’s financial model actively undermines your margin health.

Consider the real-world impact: for an app generating 2.5 millionin annual revenue,a1.7543,750** that year. This is the primary driver of non-linear cost acceleration, ensuring that as your business becomes more successful, your financial dependency deepens and your TCO will eventually overtake that of a custom-built solution.

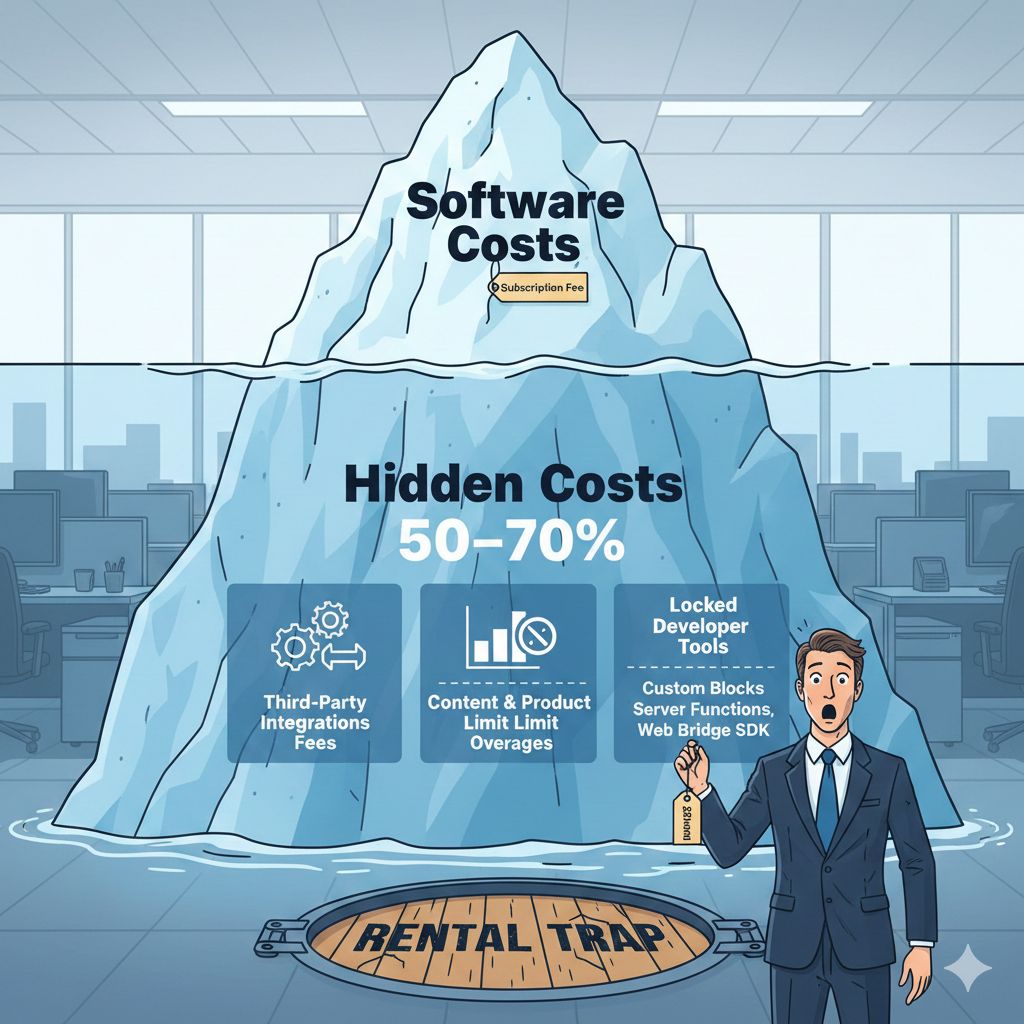

3. Takeaway 2: The Real Price Tag is 50-70% Larger Than You Think

Organizations routinely overlook 50% to 70% of total software costs, focusing only on the initial subscription fee. This is the "rental trap": a low initial cost masks a cascade of escalating Operational Expenditure (OPEX) and hidden fees. These aren't accidental oversights; they are structural components of the SaaS model, using "feature gating" to push you onto expensive Enterprise plans costing ~$1,350/month or more. This is often the only way to access functionality required for any real differentiation, such as:

• Fees for essential third-party integrations.

• Charges for exceeding content or product limits.

• Access to crucial developer tools like Custom Blocks, Server Functions, and Web Bridge SDKs needed for a unique user experience.

"For high-growth businesses, the low initial subscription costs of SaaS platforms create an illusion of affordability, functioning effectively as a 'rental trap' that sacrifices long-term strategic value for immediate simplicity."

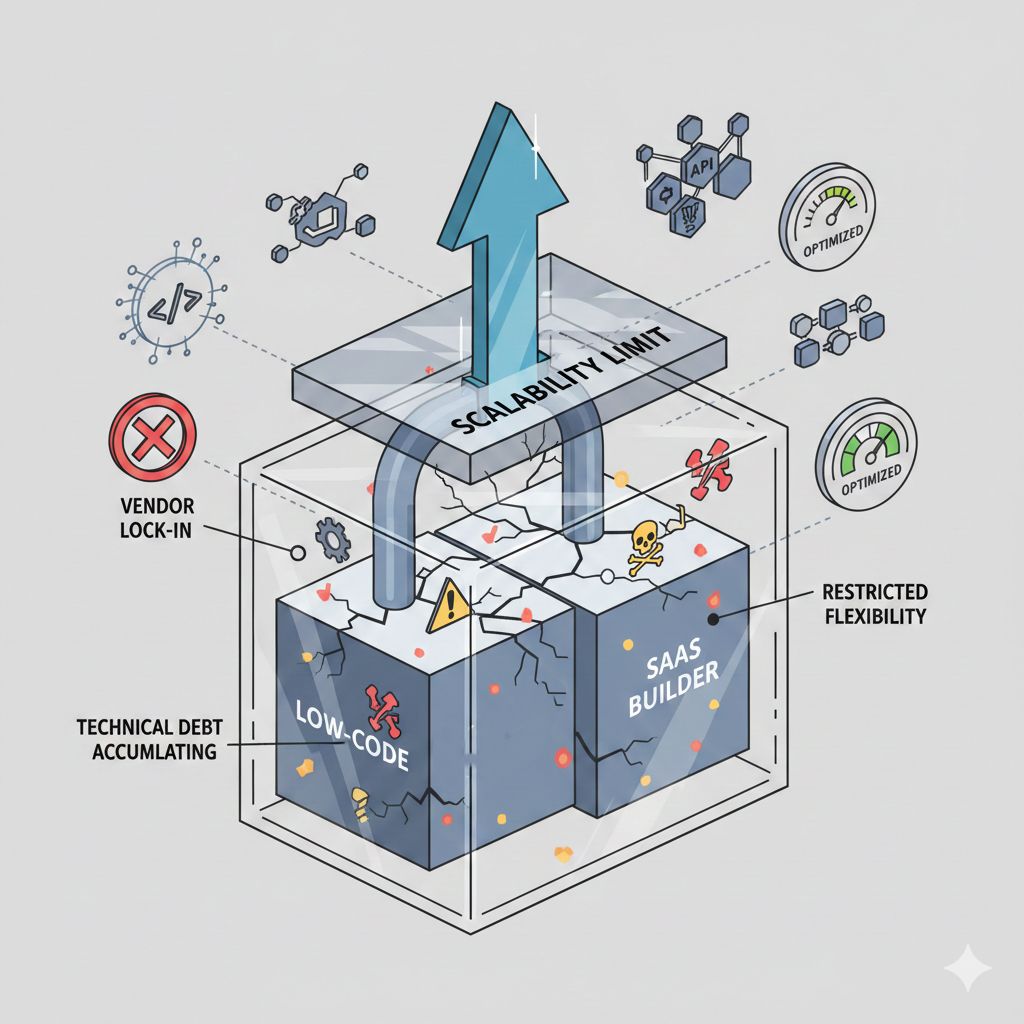

4. Takeaway 3: Your Success Guarantees an Expensive Breakup

SaaS builders create vendor lock-in through proprietary, low-code systems that inherently accumulate technical debt, which compromises future flexibility and robustness. As your business scales, you will inevitably hit a "scalability ceiling" where you need unique features, better performance, or complex integrations that the builder cannot support.

When you outgrow the platform, you cannot take your app with you. You must pay for a complete, ground-up rebuild. This mandatory migration or "breakup cost" is the critical tipping point in the TCO analysis. This single, unplanned expense, which can cost 100,000 or more by the third year is often what causes the SaaS model’s 3-year TCO (237,100)

to definitively surpass a custom build's TCO ($205,000). For a scaling brand, this isn't a risk—it is an almost certain future expense.

5. Takeaway 4: A Custom App Isn't an Expense—It's a Company Asset

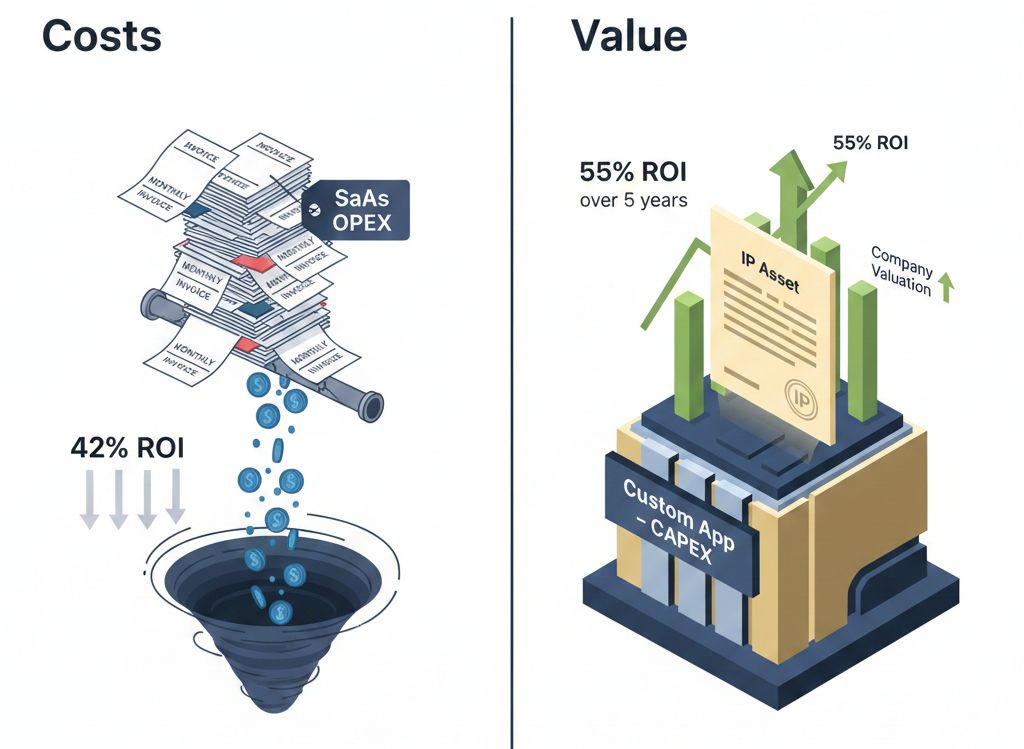

In contrast to the recurring OPEX of a SaaS subscription, a custom-built app is a Capital Expenditure (CAPEX) that your business owns completely. This proprietary software becomes intellectual property (IP) that acts as a valuation multiplier, directly enhancing your company's worth during funding rounds or an acquisition. The financial returns reflect this fundamental difference. Custom solutions report an average Return on Investment (ROI) of 55% over five years, significantly higher than the 42% average for SaaS implementations.

This CAPEX model provides fiscal predictability. After the initial investment, costs shift to stable, predictable OPEX for maintenance, insulating the business from revenue-based cost increases and enabling clear, reliable financial planning. Ownership provides complete strategic control, superior security, and the freedom to innovate without vendor limitations.

Conclusion: Are You Building an Asset or a Liability?

While SaaS app builders are tempting for their low entry cost, a TCO analysis reveals they become a more expensive and restrictive path for any business serious about growth. The choice is a strategic one: commit to a rental model of accelerating, unpredictable Operational Expenditure (OPEX) that penalizes success, or invest in a Capital Expenditure (CAPEX) that creates a company asset with stable costs and long-term equity.

As you plan your digital future, are you building a valuable company asset or simply renting a costly, long-term liability?